102: Electric Utility Industry

Electric vehicles and AI Cloud computing are waking up a giant that's been sleeping since 2005.

You’re reading the weekly free version of Watchlist Investing on Substack. If you’re not already subscribed, click here to join 2,700 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives, a separate paid service.

For $20.75 per month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the archives, now 28 issues and growing!

What follows are excerpts from the latest paid issue of Watchlist Investing.

Ubiquitous, But Not Well Understood

Electricity is probably second on the list of things you’d miss most if it suddenly disappeared (the first being oxygen). Electricity is ubiquitous and easy to take for granted, yet we’re increasingly reliant on it. Almost everyone has a computer, smartphone, and other “smart” things around their home.

The continued boom in electric vehicles and cloud computing (including artificial intelligence) is going to require vast amounts of electricity our grid is not quite ready to make or move – some estimates put the need at 2x to 3x our current capacity.1 The US is just waking up to these realities.

The job of investing hundreds of billions (perhaps trillions) of dollars to improve the electrical grid falls to the electric utility companies, many of which are investor-owned and publicly traded.

I’m intrigued enough to put three utilities on the Watchlist to follow more closely.

What is “The Grid”?

It’s important to understand what exactly “the grid” is, how it functions, and how electricity moves through it before jumping into the ownership landscape.

All electrical grids regardless of size contain three physical parts:

1. Generation: the production of electricity

2. Transmission: moving it over long distances

3. Distribution: the final mile lines to homes and businesses

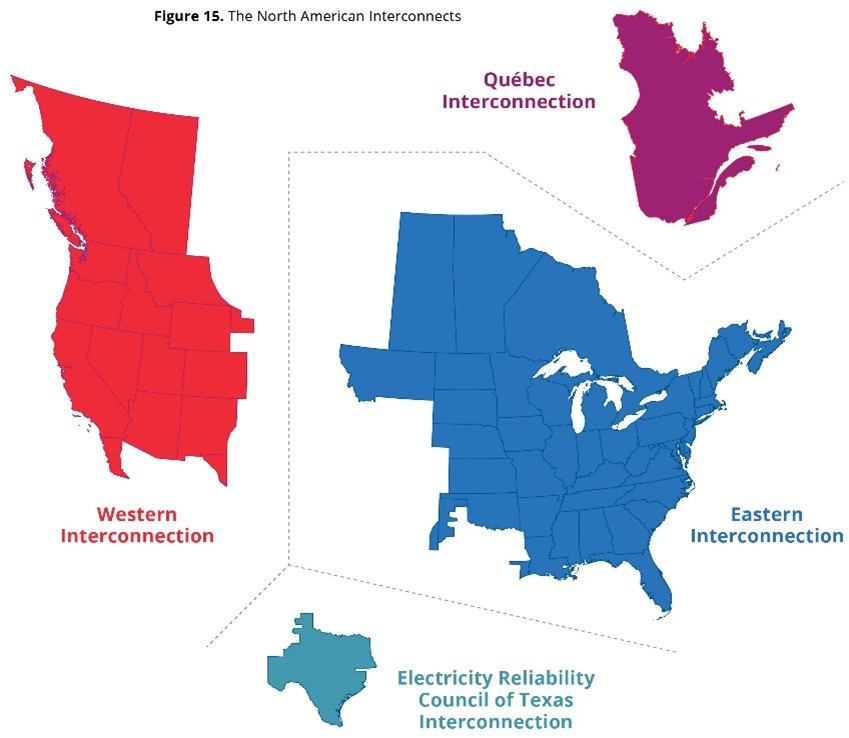

The grid as it exists today in the contiguous United States is really four separate grids or interconnections that operate mostly independently and include most of Canada. Substantially all electricity in these regions is produced and consumed within the same borders (see the graphic on the next page). The whole grid is overseen by the Federal Energy Regulatory Commission or FERC, in conjunction with the Canada Energy Regulator or CER. Within these major interconnections are smaller regions delineated for purposes of regulation and management of resources. Governmental and non-profit balancing authorities and systems operators oversee these territories and coordinate the production and distribution of electricity to meet the demands of consumers. Balancing the grid is literally a second-by-second job because power cannot be stored. It must be consumed the instant it’s produced.

How big is the market for electricity?

Electricity production (and demand) in the US has been relatively flat since the year 2005.

In 2022, the US (excluding Alaska and Hawaii) generated 4.1 petawatt hours of electricity. Such large numbers are outside of the realm of everyday use. Said another way it is:

· 4,143 terawatt-hours

· 4,142,901 gigawatt-hours

· 4,142,901,000 megawatt-hours

· 4,142,901,000,000 kilowatt-hours

The average household in the US used 10,600 kilowatts, or 10.5 megawatts. No matter how you express it that’s a lot of electricity.

Who owns the grid?

The grid is owned by thousands of different entities, both public and private. According to the US Department of Energy, 192 investor-owned utilities (i.e., direct public companies or holding companies like Berkshire Hathaway) supply 38% of net generation, 80% of transmission, and 50% of distribution.

Regulation

About a third of the generating capacity and most transmission and distribution rates are regulated. Typically, regulators will allow a certain return on equity and set boundaries for how much debt can be used. Regulations can also include provisions for what are known as stranded assets, such as an old coal plant taken offline prior to the end of its useful life. Essentially this means ratepayers subsidize the return of shareholders.

But regulation is two-sided. Warren Buffett has talked about this social compact before. The utilities must do their part to make necessary investments for the long-term viability and strength of the grid. In exchange, regulators and lawmakers should allow a reasonable return on capital employed. Most regulatory bodies allow somewhere in the range of high single-digits to very low double-digit returns on equity. In some cases, higher returns are allowed if a portion is passed back to customers.

Subscriber Benefits

My goal with Watchlist Deep Dives is to provide a margin of safety in terms of the price you pay for the subscription and the value you get out of it. Here are some of the benefits:

Access to this full issue, which delves into the industry more deeply, including regulation, key metrics, analysis of the aggregate industry financials, and more. The issue also contains a summary overview of a dozen or so public electric utility companies, including the three mentioned above, and a link to my spreadsheet of all of the electric utility companies.

Access to all back issues, now 28 and counting

Private Google meetups where we discuss the latest issue, current events, interesting stock ideas, investing concepts/definitions, and more

Access to all recordings of previous meetups

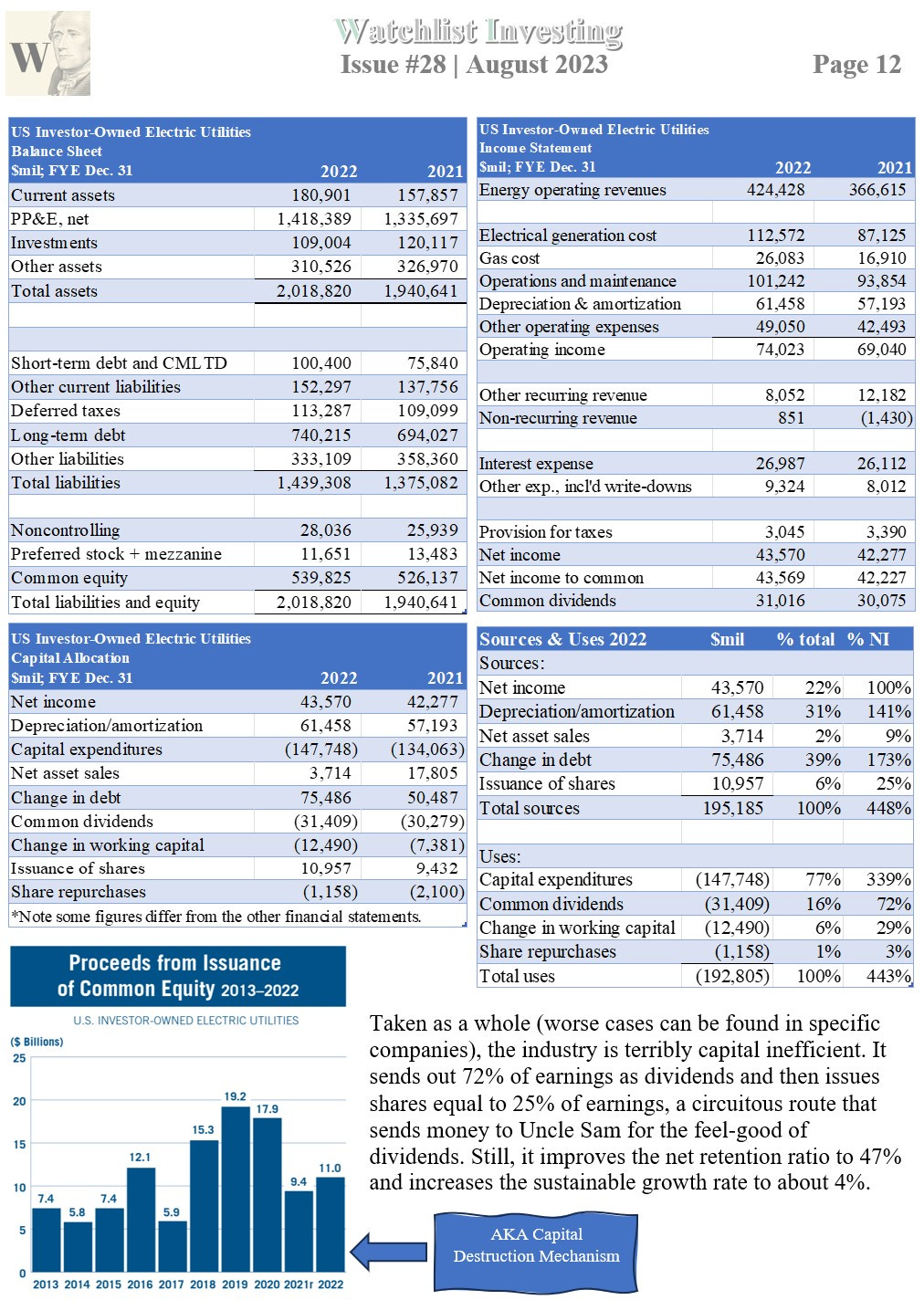

Stay rational! —Adam