103: Football Holds Clues To Successful Investing

American Football or Soccer (Take Your Pick) Is A Good Way to Think About Investing

You’re reading the weekly free version of Watchlist Investing on Substack. If you’re not already subscribed, click here to join 2,700 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives, a separate paid service.

For $20.75 per month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the archives, now 28 issues and growing!

A Decent Analogy

Football (American or Soccer, take your pick) is a good way to think about investing. An American football team has a maximum of 53 players with 11 allowed on the field at once. I think this is a great analogy for how to conduct an investment operation. You have a watchlist of good stocks but only a few should be in your portfolio.

The numbers are about spot-on too. Done right it’s hard to build a watchlist of 53 companies you know well. This got me thinking…

Possible Changes To The Watchlist

I’m considering modifying the format of my watchlist. Currently, it has a list of 30 names including those active in my portfolio. Those companies span 11 industries by my count, which is probably too many.

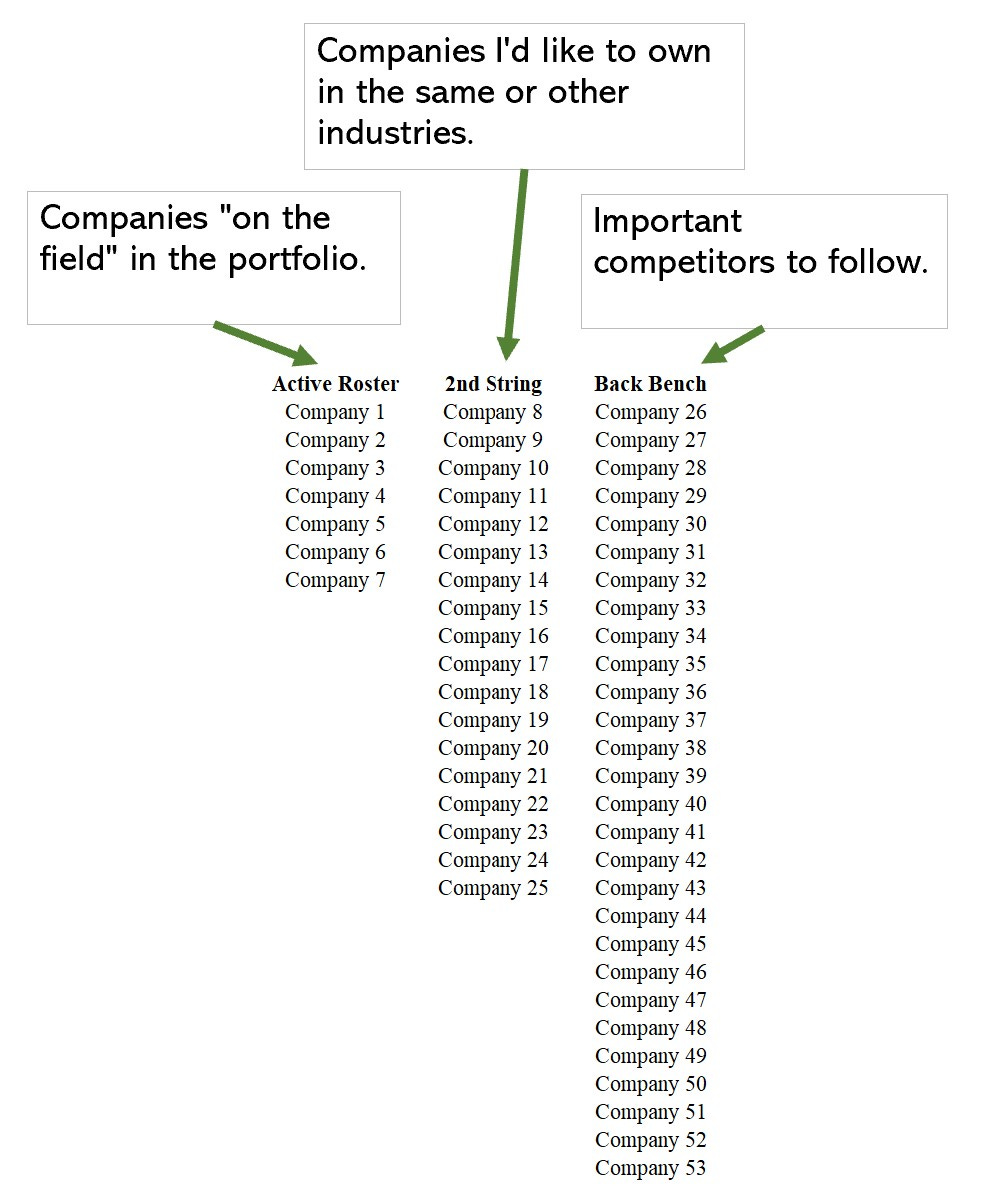

The industry count should come down for starters. Keeping up with that many industries is not feasible if I’m being honest with myself. After paring down the number of industries I would expand the watchlist to include three tiers:

Active Roster: Those “on the field” currently in my portfolio.

2nd String: Companies I’d like to own at the right price, possibly in the same industry as the active companies but not necessarily.

The “back bench” watchlist companies. These would be all the companies I don’t necessarily want to own but should be following to inform my decision-making for the first two tiers. I do this already to a large extent but this would formalize the process for subscribers.

Other Benefits / Considerations:

There are additional benefits to this approach, too. The cap of 53 neatly fits within a year. You could spend one week looking at each company, for example.

In practice, you want to follow your active companies more closely. That means reading quarterly filings, proxies, conference call transcripts, industry journals, etc. Keeping up with the things an active owner would do.

Companies in the 2nd tier probably deserve as close a look but could slip to 2x/year or even once per year in a slower-changing industry.

Those in the “back bench” aren’t unimportant, since they provide important context for gauging the performance of the first-stringers. But these companies don’t require as deep of an analysis or as frequent. For example, I didn’t need to read YRC’s proxy statement. The company is (was?) a disaster that I’d never own. Leafing through their 10K once a year would probably be fine to stay on top of developments.

Putting It Into Practice:

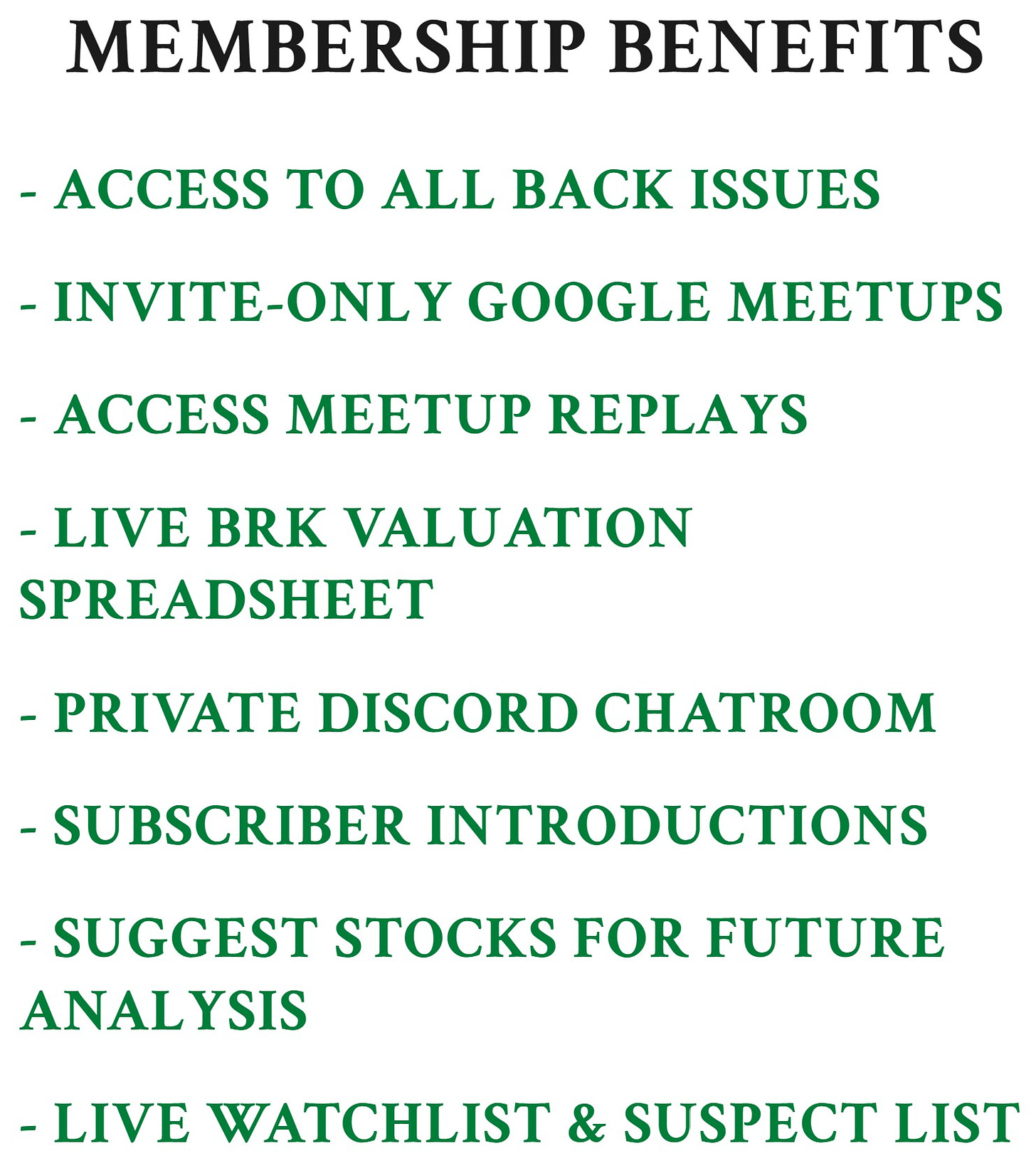

This has turned into a thinking-out-loud piece for how I might change the watchlist for paying subscribers going into next year. If you’re not already a subscriber join us! Look at all these great benefits…

::: END COMMERCIAL :::

Anyway, what that means for the paid Deep Dives service is more watching of the watchlist and fewer brand-new deep dives. It might include some refreshes of writeups done years ago and/or quick updates from time to time.

Thinking out loud, if I did 4x updates on ten portfolio companies that’d be 40x / year. Plus quick updates on 2nd tier and tertiary companies would be a good amount of updating.

I’m fearful of a) creating too much work for myself; and b) providing something that’s not valuable to subscribers, or that they could easily get elsewhere. I would be doing the work of keeping up with these companies and providing my insights/expertise, which is what a research service is supposed to do, after all.

What would add the most value to your investment process in a service like this? What would you change, add, remove, etc.? Hit reply or leave a comment below.

Stay rational! —Adam