113: Boston Beer: The Tale of Mr. Market In Two Charts

Wall Street demonstrated its irrational exuberance in shares of SAM.

You’re reading the free version of Watchlist Investing on Substack. If you’re not already subscribed, click here to join 2,900 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives, a separate paid service.

For $20.75 per month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the archives, now 32 issues and growing!

*Disclosure: I own shares of Boston Beer.

One Company, Two Charts

I’m in the process of putting the finishing touches on my last issue of Watchlist Investing Deep Dives for 2023, a quick two-page update on Boston Beer Company. (Side note: I first wrote about SAM in 2021. You can view the entire Deep Dive free here: Sample Issues.)

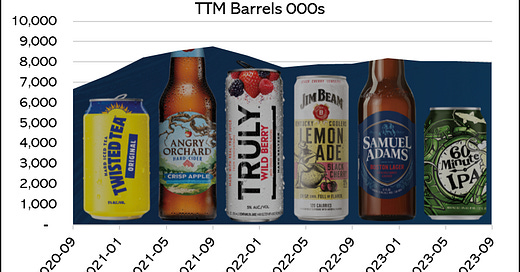

I don’t use charts to make decisions but it’s always interesting when graphical representation of data highlights interesting contrasts. Case in point: The first chart is Boston Beer Company’s trailing twelve-month volume beginning in the third quarter of 2020. Over the next year, the company rode the boom in hard seltzer, ultimately attaining the #2 spot behind privately held Mark Anthony’s White Claw. Total beer volume increased 31% to 8.8 million barrels (TTM basis).

What would you expect the stock to do? Of course, this is hindsight, and I’m giving you little else to go from. Perhaps you’d expect the stock to follow suit, as stock prices generally track business results over time. Did the price of the stock go up by a third? Perhaps less, since innovations are often short-lived? Or maybe it went up slightly more as the market judged a new trend in “beyond beer” to continue? Nope…

Here’s what happened… The stock went from around $400 per share to over $1,000 by mid-2021, an increase of 150%. Shares peaked at around $1,300 and have since declined to slightly below the $400 mark again. To me, this is a clear demonstration of the power a narrative has on a stock. Mr. Market got very excited, perhaps experiencing some FOMO, and bid the company’s shares up 5x the level of underlying physical volume growth.

Now, there was no way of knowing that the hard seltzer category wasn’t going to grow even further. But it was perhaps reasonable to assume one or a combination of:

Reversion to the mean as “everyone” tries out the hot new product with only modest changes in long-term consumption patterns

Competition negates the benefits of the category leader.

What happened was roughly that. Consumers tried the product, sales went through the roof, and the competition saw the increased volume and jumped on board. Today the category is still viable just finding its level drinkers assimilate to the new category and a plethora of flavors and combinations.

My history with SAM goes back about 15 years. Then I thought shares were expensive at $35/share. The fall of the stock price from its heights intrigued me, and I began to study the business more closely. I liked what I saw and decided to become an owner. Today the business is following a more normal trendline and recovering from a bit of a hard seltzer hangover. The business is debt-free, repurchasing shares, and run by its founder.

I discuss this and more in my update to paid Deep Dives subscribers. Please consider subscribing to the full service or even supporting me with a monthly subscription here on Substack for as little as $10/month.

Cheers, and see you in 2024!

Stay rational! —Adam

Hi Adam, hope you're doing well.

I had a question, do you still use Greenwalds Earnings Power Value and Growth return method to value this stock similar to the free sample issue?

I've been trying to learn Greenwalds methods (honestly, it's not been too easy and taken a few re-reads just to understand a bit.)

I've been able to do EPV, but the organic growth portion and active reinvestment portion don't make sense to me. Do you have any resources I could use? I also don't try to re-create balance sheets, just don't feel confident in getting an accurate reproduction value.

I hope to subscribe in the future, to get into your subscriber talks and read your book soon enough :)