116: Watchlist News

Links to some articles and news related to Watchlist companies, plus a sprinkling of commentary

You’re reading the free version of Watchlist Investing on Substack. If you’re not already subscribed, click here to join 3,000 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives, a separate paid service.

For less than $25 per month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the archives, now 33 issues and growing! Other benefits include access to a live Berkshire Hathaway sum-of-the-parts valuation model, private subscriber-only Google Meetups, and subscriber introductions.

Berkshire Hathaway

Railroad regulator proposes 2-person crew: The rail industry’s regulator is proposing a rule to require at least two member crews. BNSF, along with Union Pacific and two short-line rails filed challenges, saying it was unnecessary and would hurt consumers. This is one of those “threats” that would affect every industry participant so the net effect would be nil (I think) within the railroad industry. But it would shrink the advantage trains have outside the industry, namely over trucking.

Berkshire issues $1.7 billion of Yen-denominated bonds: Is Buffett gearing up for more purchases of Japanese equities or simply taking some risk off the table by hedging some of the gains on prior purchases?

Hingham Institution for Savings

First quarter results: Hingham released its Q1 results showing continued (but slowing) contraction in net interest margin and spreads. NIM went from 0.89% in Q4 2023 to 0.85% in Q1 2024. Spreads went from 0.17% to 0.13%. That the bank still generated positive Core ROA (0.20%) and Core ROE (2.14%) is a testament to the low-cost model. I plan to attend the bank’s annual meeting next week (which finally doesn’t conflict with my annual BRK pilgrimage).

Triumph Financial

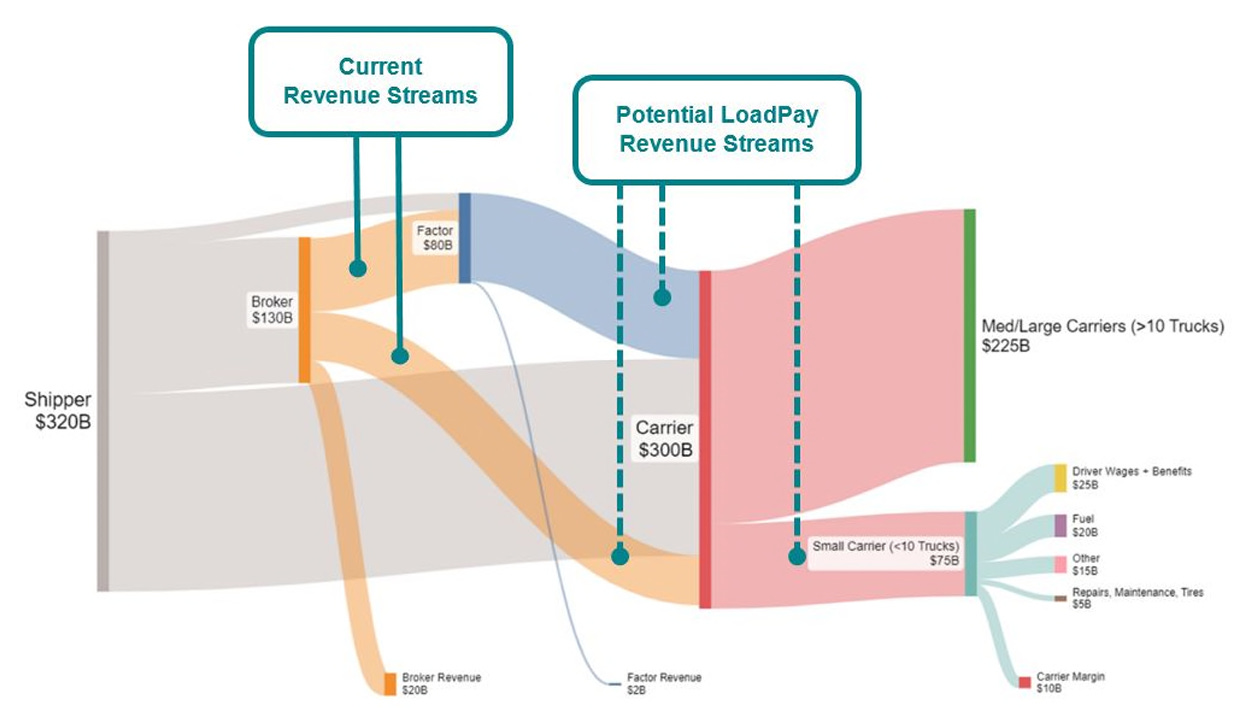

First quarter results: Q1 results reflected continued weakness in the trucking market, now going on 24 months of freight recession, the longest in history. On the plus side, Triumph added new companies to TriumphPay, including Werner Enterprises, and Fitzmark. The bank opportunistically increased its construction portfolio during the quarter. TPay network volume continued to grow, topping $1 billion in the quarter.

Here’s a nice graphic showing the company’s potential to tap into other revenue streams with its nascent LoadPay offering:

Lastly, the company disclosed that it took advantage of low office prices to secure a new HQ building.

Stay rational! —Adam