An Hour of Wisdom

My friends Jeff Gilbert and Bogumil Baronowski had a great conversation on Bogumil’s Talking Billions podcast. I learned a lot in this fun and enlightening hour-long video.

New Research Tool

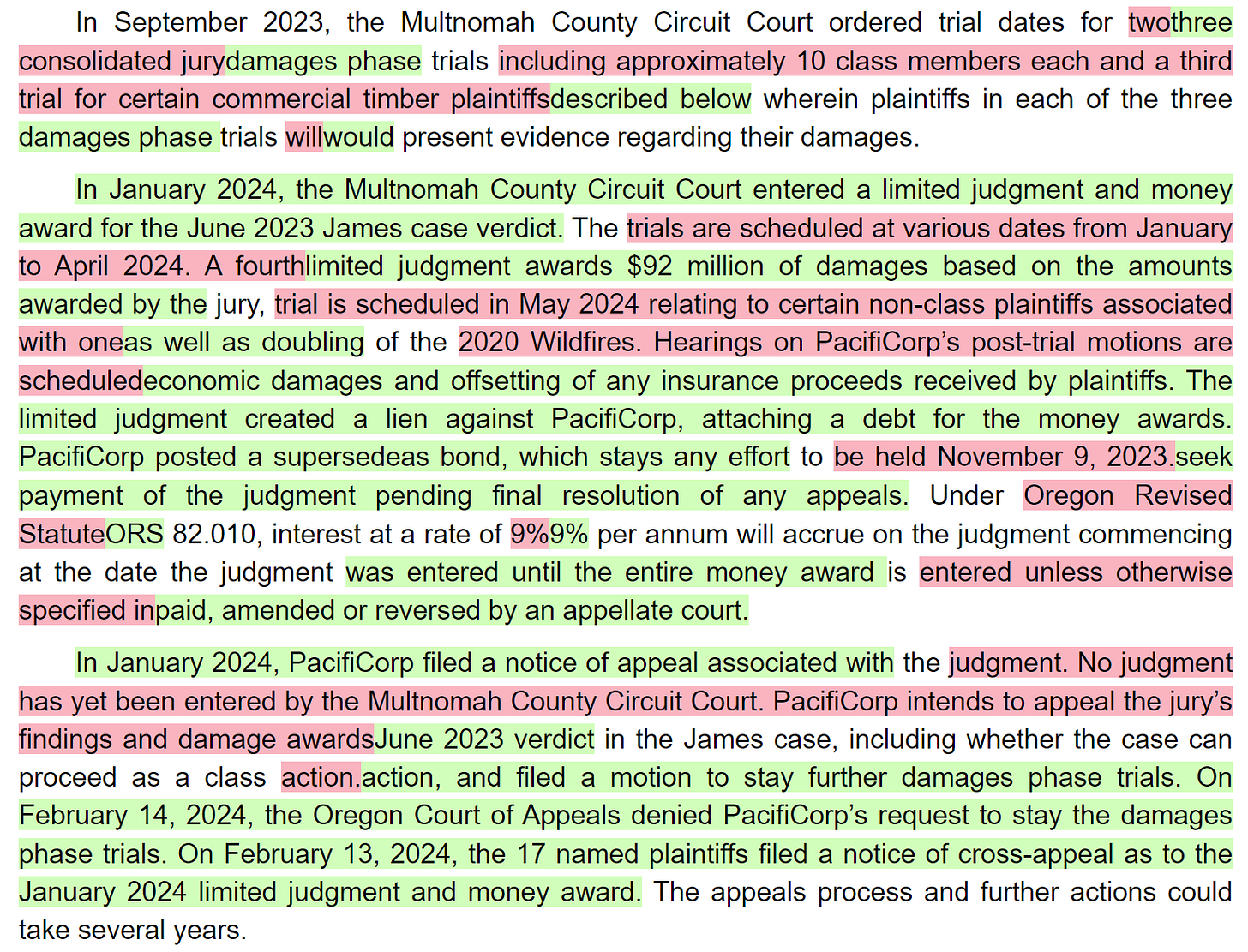

I started testing CapEdge, a service by Finsight. It’s a free tool with many cool features like filings, transcripts, and news. Perhaps its coolest feature is the “View Diff” tool which allows you to compare the language between filings. I’ve wanted to use a tool like this for a long time but haven’t wanted to pay for the services that provide these “delta” reports. Nor have I taken the time to use the compare tools in Word or Adobe, which are cumbersome. This makes it a breeze, and it’s all free! (As an aside I’m curious — one might even say skeptical — why this service is free and what the company that runs it is getting out of it. But I’ll take it while it lasts.

Here’s the view diff feature with Berkshire’s Q1 filing. Red is the wording deleted and green is the wording added. Note that this compares Berkshire’s Q1 2024 filing with the Q3 2023 filing. I’m guessing that’s because the annual report is classified differently. Of note, you cannot change the filing you compare to.

Borsheims Stats

Half of Borsheims’ (one of Berkshire’s three jewelry store operations) sales come from outside of Omaha. h/t

for this video, which also features Gorats and Nebraska Furniture Mart.BNSF as-a-Bond?

In case you missed it, in a post earlier this week I took some time to think about Buffett’s comments about BNSF and if/how its 2010 purchase price was still relevant today.

Reinsurance Pricing

The WSJ (paid) reported on the big increases in reinsurance driving the rate increases in the South and elsewhere. Ignorant observers (no other way to put it) think it’s reinsurance driving the bus when it’s the loss experience of the primary insurers and expectations of higher costs that are the real culprit. We are in a tight market for reinsurance with very good recent results seen across the industry (see BRK and Chubb). But such results sow the seeds of future competition and pricing cuts, which will — at some point — cause industry losses.

Modern Day Trading Stamps…Starbanx?

Marc Rubinstein has a free post about the “banks” inside companies like Starbucks, Carnival, Delta Airlines, and others. This reminds me of the float inherent in the trading stamps businesses of old. Think Blue Chip Stamps at Berkshire.

Excess Returns Podcast

I joined Jack and Justin on their podcast to discuss all things Berkshire.

Stay rational! —Adam

Should check out Koyfin if you like Capedge