One thing I’ve struggled with since writing my book on Berkshire Hathaway, starting a YouTube Channel, and founding Watchlist Investing is how to tie it all together. I think Substack is the answer.

My plan is to increase these emails from once every Friday to perhaps 2-3x/week. The goal will continue to be exploring timeless investing concepts in the search for great businesses.

Thanks for being on this journey with me! -Adam

“You will never see us reaching for an extra eighth of a percent.” - Warren Buffett

Where and where not to take risks with cash:

Time was you could park idle funds in Treasuries and earn high single-digits. Today you’re lucky to break 0.25% on anything shorter than a year. All of this creates temptations to stretch a little and earn a bit more. Risks abound.

The last several years have seen investors stretch and stretch for yield. It started with a move from the debt of higher-rated companies to slightly lower-rated ones. Then credit investors stretched some more by allowing loose or unprotective covenants. These so-called “cov-lite” deals led to the issuance of loans with no covenants as the stretch continued. I even saw a “tactical bond fund” marketed to my risk-averse mother-in-law as a safe investment, assured that a fund of funds could dart in and out ahead of any maelstrom (for a hefty 2% fee of course).

We’ve even seen dividend-paying stocks substituted for bonds even though they have no contractual right to cash. Just recently I read about the magic of defi (decentralized finance) where you can earn a “safe” 4% by giving your cash to an operator who turns it into cryptocurrency and lends it out. Sure, that sounds safe.

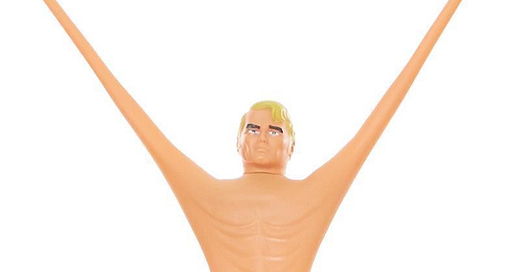

It all reminds me of the old toy Stretch Armstrong. Unlike that childhood toy, however, today’s investors won’t automatically go back to normal when the fun stops. They risk their arm falling off in the reach for just a little more yield.

Berkshire’s Playbook

“We do not get venturesome in the least in terms of where our short-term money goes.”

- Warren Buffett

It won’t surprise you to learn that Berkshire Hathaway has a different playbook. US Treasuries are the go-to place to park cash. In the video below Buffett says he allows just a handful of commercial paper issuers but that’s been a very minor part of the equation at Berkshire over time. Treasuries are simply the only place Berkshire can park its large amounts of cash where it’s 100% safe and ready at a moment’s notice.

Buffett is too astute a student of history to stretch for a little yield. He knows that markets can change or freeze up literally overnight. In the video, he references the 1970 bankruptcy of Penn Central, the behemoth of its day. You could have had a perfect record for 300 years and then made a fatal mistake by investing in the short-term paper of a supposedly gilded-edge company of your day.

Better to stick to certainty when it comes to needed ready cash. What that means for you and me is either an FDIC-insured (or DIF if you can find it) bank or Treasuries.

Stay rational! —Adam

P.S. If you’re interested in some additional historical case studies of market disruptions check out Lombard Street (written by Walter Bagehot in 1873), Manias, Panics and Crashes (new revised 7th ed. available), and Devil Take the Hindmost: A History of Financial Speculation (a classic written by Edward Chancellor).

It's interesting he considers assets with a negative real return - Treasuries - as "real money"

Warren said it best at the Financial Crisis Inquiry Commission in 2010.

Mr. Buffett: I mean, we don’t have a whole list of approved short‑term investments around here, you know. We’ve got Treasury bills, basically. And the Treasury is going to print money, if necessary. And that is AAA, I’m willing to go on record on that.

Mr. Seefer: You’re giving that rating yourself.

Mr. Buffett: But nobody else is AAA, in my mind, you know. And if we’re really going to protect ourselves ‑‑ if we’re not going to ‑‑ we need to have real money. Now, I let the smaller operations, just for matters of convenience, do other things. But in terms of the vast chunk of what we have around here, it’s treasuries, and it will stay that way. Because I don’t know what could happen tomorrow. I don’t know if there’s ‑‑ you know, pick any kind of a hugely disruptive ‑‑ that’s what you have to worry about, is the discontinuities. And there will be one someday. They closed the stock change in 1914, you know, for many months. They closed it for a few days after 9/11. But who knows what happens tomorrow?