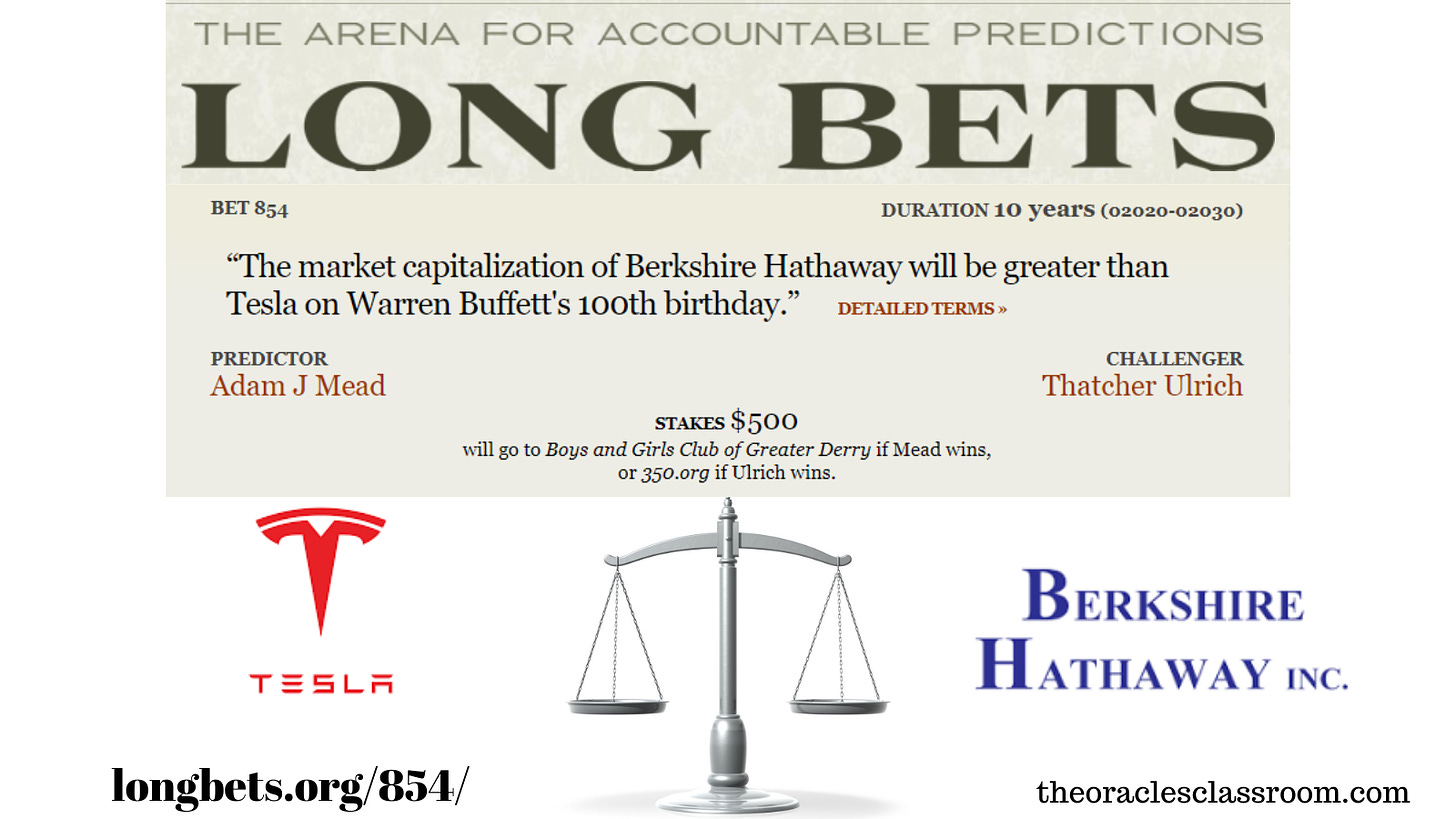

29: My Longbets.org Prediction Finally Has A Challenger!

Berkshire Hathaway vs. Tesla ... For Charity

One thing I’ve struggled with since writing my book on Berkshire Hathaway, starting a YouTube Channel, and founding Watchlist Investing is how to tie it all together. I think Substack is the answer.

My plan is to increase these emails from once every Friday to perhaps 2-3x/week. The goal will continue to be exploring timeless investing concepts in the search for great businesses.

Thanks for being on this journey with me! -Adam

The Origins Of A Bet

In 2008, Warren Buffett famously wagered $1 million that over a ten-year period an unmanaged index (the S&P 500) would beat a fund of funds after fees. Ted Seides of Protege Partners took up Buffett on his wager. Buffett gave himself 50/50 odds. In the end, as Buffett usually does, he came up on top—and by a good margin. This post isn’t about Buffett’s bet, which you can read about here. Rather, I followed his lead in making a bet of my own.

I don’t short stocks. In fact, I don’t use margin, options, futures, etc. My investment process is kept simple (which is hard enough). But I digress. Just because I don’t bet against stocks doesn’t mean I don’t have an opinion.

Love The Company; Hate The Stock

Here’s the thing: I actually like Tesla cars. I’m rooting for the car company. But excitement for a company or its product doesn’t justify exuberance for its stock. I don’t know enough about Tesla’s financials to debate the finer points. Even from a distance, however, the stock price is bats*#! crazy.

One trillion dollars. A million millions. That’s how much “investors” (speculators) are saying Tesla is worth today. It’s insane. At that price, buyers are saying Tesla can give them something like $50 billion a year next year, which would be a 5% return. Or well over $100 billion a year in very short order if you go out a few years and have any reasonable semblance of a discount rate. It’s madness. You can count on one hand the entities capable of earning such sums. Others have been burned by shorting Tesla, some over and over again. I don’t know when the madness will stop. But it will end eventually.

A Win/Win Bet

Enter my Longbets.org prediction. I wanted to express my opinion on Tesla without making a speculative bet. So I decided to see if anyone would challenge me on Longbets.org, an organization dedicated to accountable bets over an unlimited timeframe (go check it out, you can make a bet they’ll track ten thousand years in the future).

I put up $250 that Berkshire Hathaway’s market cap would be more than Tesla’s on August 30, 2030, which is Warren Buffett’s 100th birthday. My rationale was that Berkshire possesses real assets and earning power while Tesla is a fledgling car company that happens to be a hot stock.

I’m happy to report that Thatcher Ulrich (who as an aside also happens to be a New Hampshire native), took me up on the bet and became its challenger. His argument is simple: Tesla is akin to an iPhone on wheels and will earn—and be marked by the market—accordingly.

The way Longbets works is each side puts up an amount. The winner’s charity takes the spoils, in this case, $500.

I chose the Boys and Girls Club of Greater Derry, a wonderful organization that helps kids and families, and is deeply embedded in the community. Having a safe place to go before and/or after school helps not only the kids but the parents and their employers too.

Thatcher chose 350.org, an organization dedicated to moving civilization toward a 100% renewable future.

I of course think I’ll win, otherwise, I wouldn’t have made the bet. But if I lose the bet I’ll consider it a win too. 350.org looks like a great organization. We need to move closer to using direct sunlight as our primary source of power. Thatcher’s chosen non-profit is working to get us there.

I’ll be back to report in nine years how the bet turned out.

Stay rational! —Adam

Not ready for the full paid version but still want to support my work? Check out my Patreon page. Thank you!