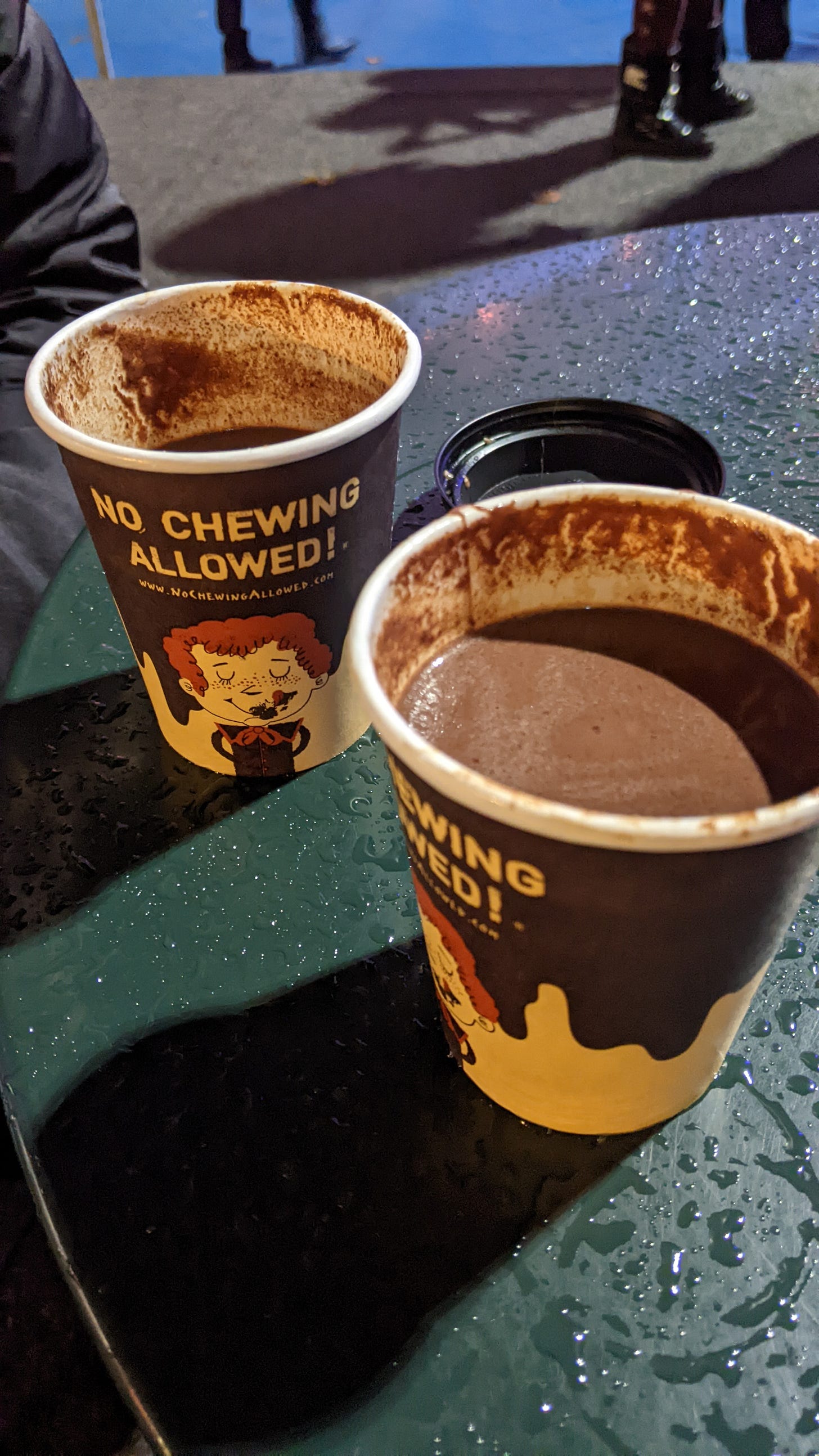

37: Buffett's Coca-Cola Analysis; My Trip To New York; The Best Hot Chocolate I've Ever Had

Mmm chocolate...

You’re reading the weekly free version of Watchlist Investing. If you’re not already subscribed, click here to join 900 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives.

For less than $17/month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the growing archives.

A Lesson From Buffett’s Lifelong Coca-Cola Obsession

Warren Buffett maintains a lifelong enthusiasm for his first job. At age 7, he purchased six packs of Coca-Cola from his grandfather’s grocery store for a quarter and sold the individual bottles for a nickel, pocketing five cents.

Fast forward fifty years to 1987 and Buffett began buying Coke for Berkshire Hathaway, ultimately purchasing what’s now 400,000,000 shares (due to splits) or 9.3% of today’s outstanding shares. All the while Buffett has thought of Berkshire’s stake as its own mini soda company.

Below is a clip of Buffett describing a somewhat unusual analysis of owning KO shares. It’s really pretty simple:

Berkshire’s share of ownership

Times Coke’s annual servings

Times Coke’s profit per serving

Berkshire’s share of KO was going up because of share repurchases by the company. This meant BRKs “mini soda company” (its share of servings) was increasing two-fold: once from increased ownership and again from underlying business growth.

And on top of that KO was increasing profit per serving.

Coca-Cola, and BRK by extension, also had a huge tailwind at their back in the form of the increasing world population and income growth across many countries.

New York City Trip

My wife and I took a trip to NYC this past weekend. Here are a few of my highlights:

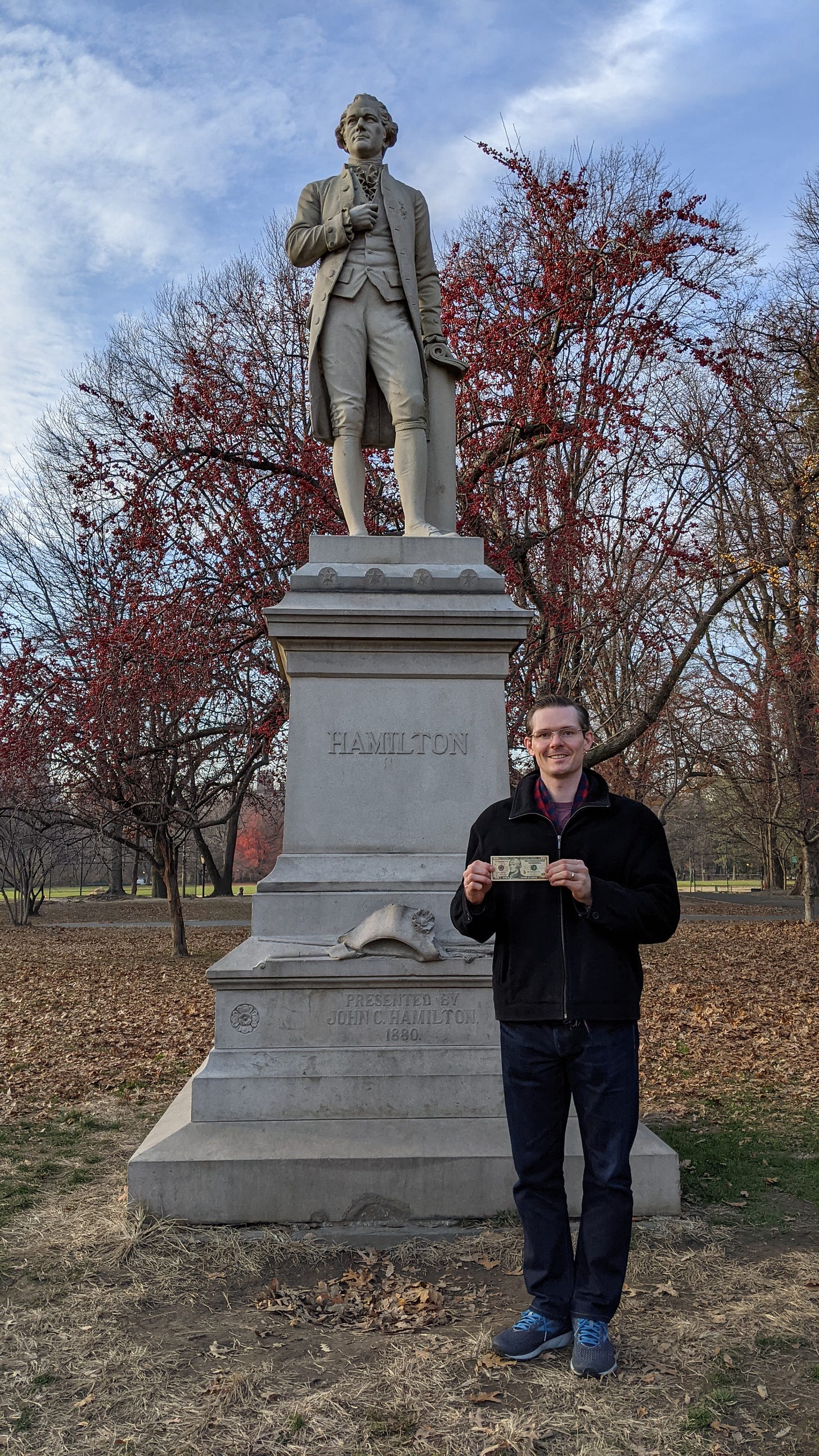

Visiting Alexander Hamilton:

I’ve become more and more engrossed with the life of Hamilton. He was an incredible statesman, polymath, and financial thinker. He quite literally invented or put into place many of the financial systems in place today in the United States and around the World. Here’s a photo of me with the statue of Hamilton in Central Park behind the Met Museum.

Another, this time from Weehawken, New Jersey, the famous dueling ground where Aaron Burr fatally shot Hamilton.

A bonus was being able to see the entire Manhattan skyline in the distance across the Hudson River.

Here’s a view of the Empire State Building from street level looking up. It was a cloudy night and the building seemed to reach into the heavens.

Lastly, we had some hot chocolate in Bryant Park that quite literally and without exaggeration was the best I’ve ever had in my life. We bought some to bring home and it was as good homemade as in the park. The company is called No Chewing Allowed and is NYC-based.

Stay rational! —Adam

I can smell the chocolate through my screen. The mind is a powerful thing!