46: W.I.N. Substack Milestone; Buffett On Getting Started, Gaining Business Experience; Career Recommendation; Vicarious Experience

That fourth digit sure feels good

You’re reading the weekly free version of Watchlist Investing. If you’re not already subscribed, click here to join over 1,000 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives.

For less than $17/month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the growing archives.

Buffett On Where To Start

The short video clip below contains Buffett’s response to a student, but it is a good reminder for investors of all levels of experience.

Know accounting cold. It’s the language of business.

Gain as much experience as you can. (It’s easier than you think.)

Read as much as you can.

My last two Substack posts were a sort of mini-series on my experience operating a firewood business and buying a dirtbike pipe repair/welding business. But you don’t have to start or buy a business to get a similar experience.

Buffett notes in his reply that you could get it anywhere. Even your first-time job in high school can teach you a lot about business. Working at McDonald’s, an ice cream stand, or the supermarket can teach you a lot if you’re paying attention. How did these businesses come to be? What sort of systems are involved in getting the product to customers? Who are their competitors? How are pricing decisions made? Etc.

I had the good fortune to start in commercial lending right as the 2008 crisis hit. It was a formative experience that showed me first how businesses could go off the rails. I then spent a decade in banking and saw the good times return. I’d recommend anyone looking for a career in investing to consider banking. I learned a ton about accounting, economics, finance, law, you name it.

Perhaps the best part was interacting with business owners and their management teams. I had front-line access to basically interview these businesspeople on a regular basis and see in near real-time how the decisions they made impacted the bottom line, and the challenges they were having. All of this vicarious experience helped make me a better investor.

Banking might not be for you. But you can start gaining business experience today. Just get curious. Next time you’re at a local store, ask the owner or manager questions about the business. Odds are they’ll get talking. Ask what keeps them up at night, what sorts of challenges they’ve recently overcome, etc. You’ll learn a lot just by asking.

You can file the information away for later use and build up the knowledge base that’s so critical to have as an investor.

Thank You!!!

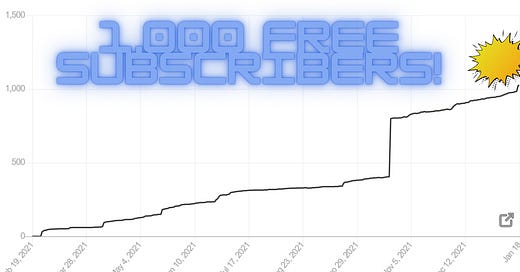

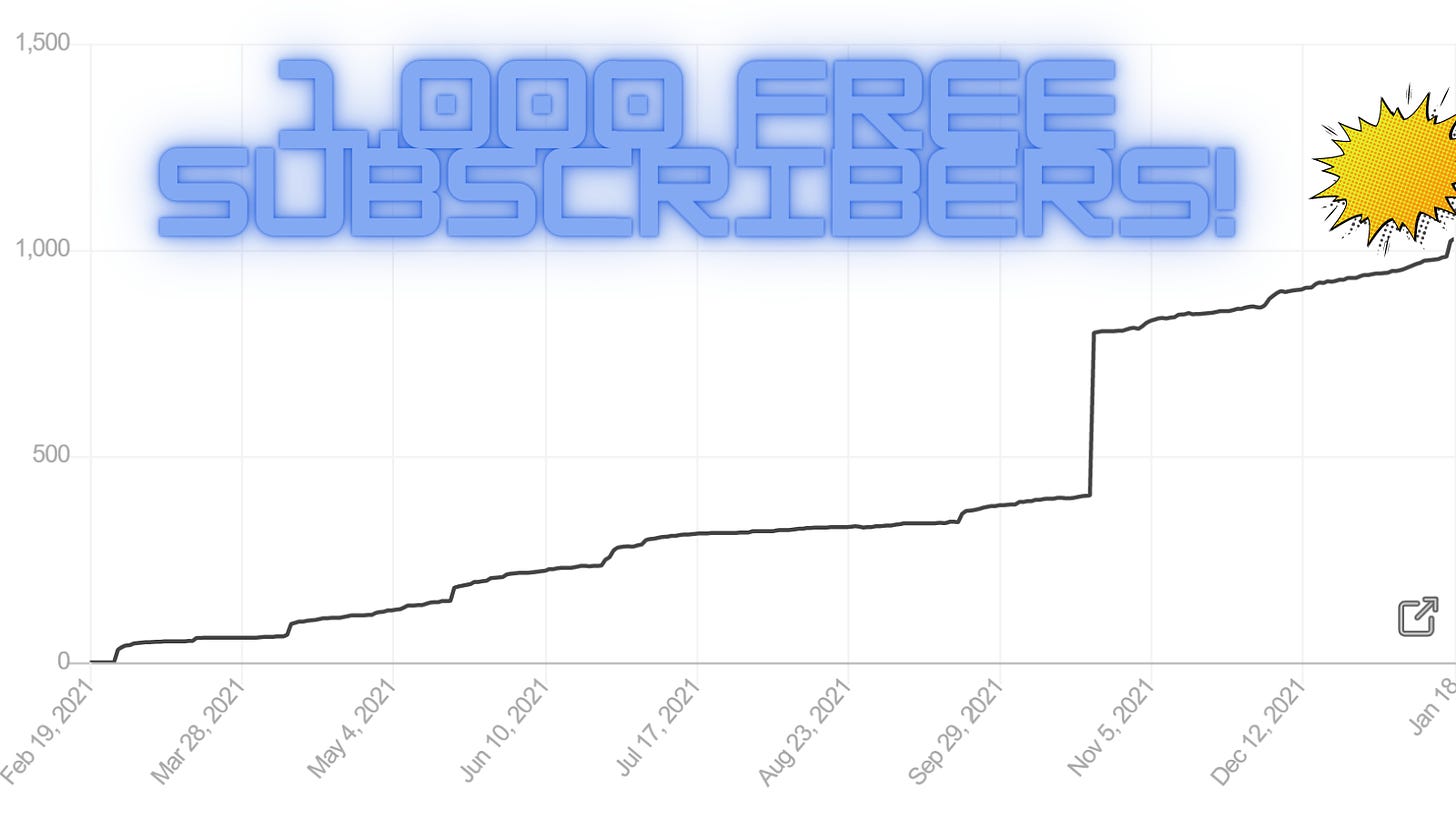

Watchlist Investing Substack edition (this newsletter) just crossed the 1,000 mark. Add in Twitter and other social media and the posts are regularly getting 1,500 to nearly 2,000 views. I’m extremely grateful to each of you for tuning in to hear me talk about value investing, business, and a whole lot of Buffett/Berkshire!

Are you enjoying the new format of multiple emails per week? Is there something I should be doing to improve the reader experience? Suggestions for things to write about? Let me know in the comments section (link below).

If you enjoyed this post I’d appreciate you taking a moment to help me spread the word by sharing it. Thank you!

Stay rational! —Adam