62: 3/22/22 Watchlist Update; Affirming AB InBev and Heineken

You’re reading the weekly free version of Watchlist Investing. If you’re not already subscribed, click here to join 1,100 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives.

For less than $17/month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the growing archives.

Latest Watchlist

Click the image to see the live Google Sheet.

Affirming AB InBev and Heineken

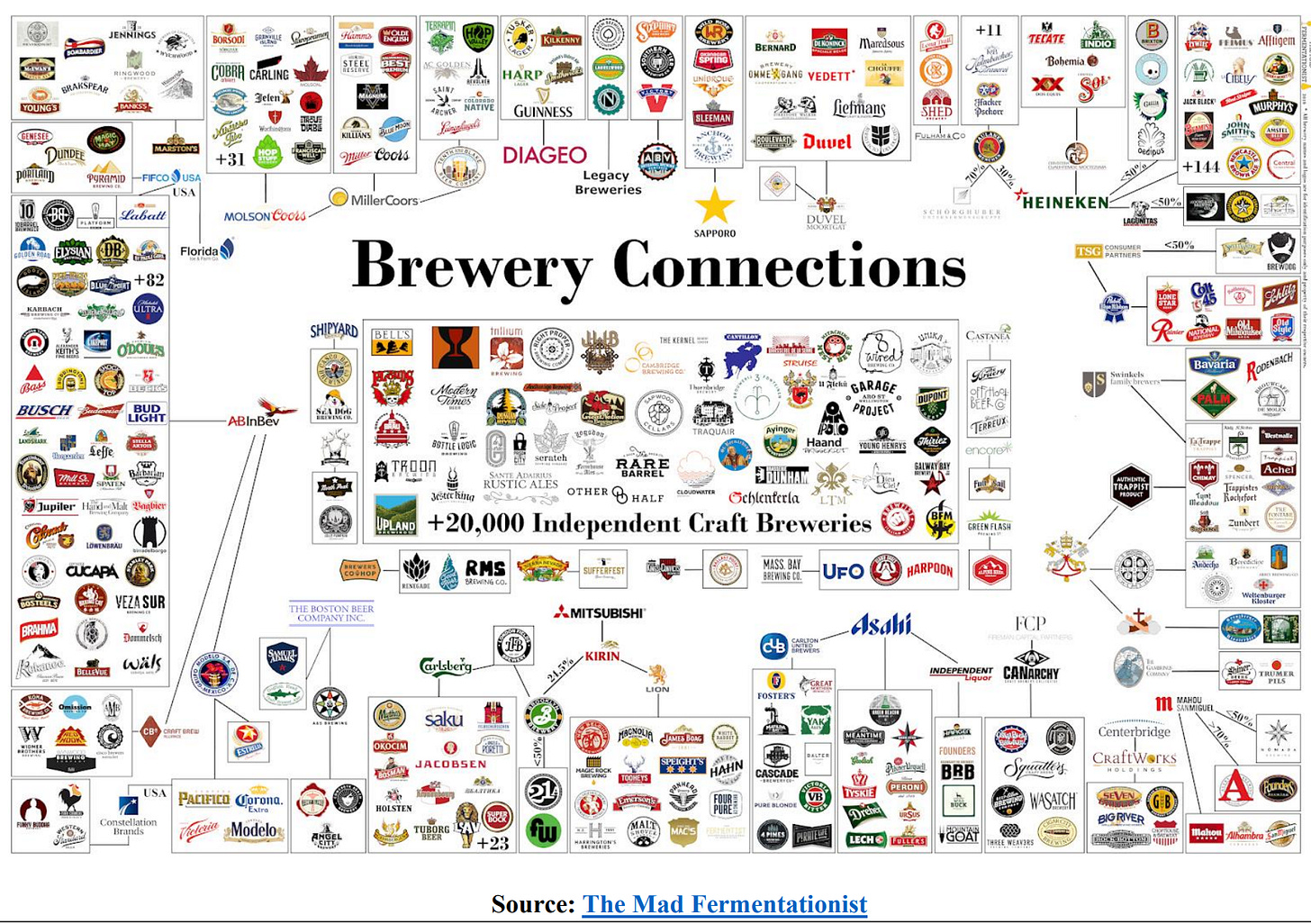

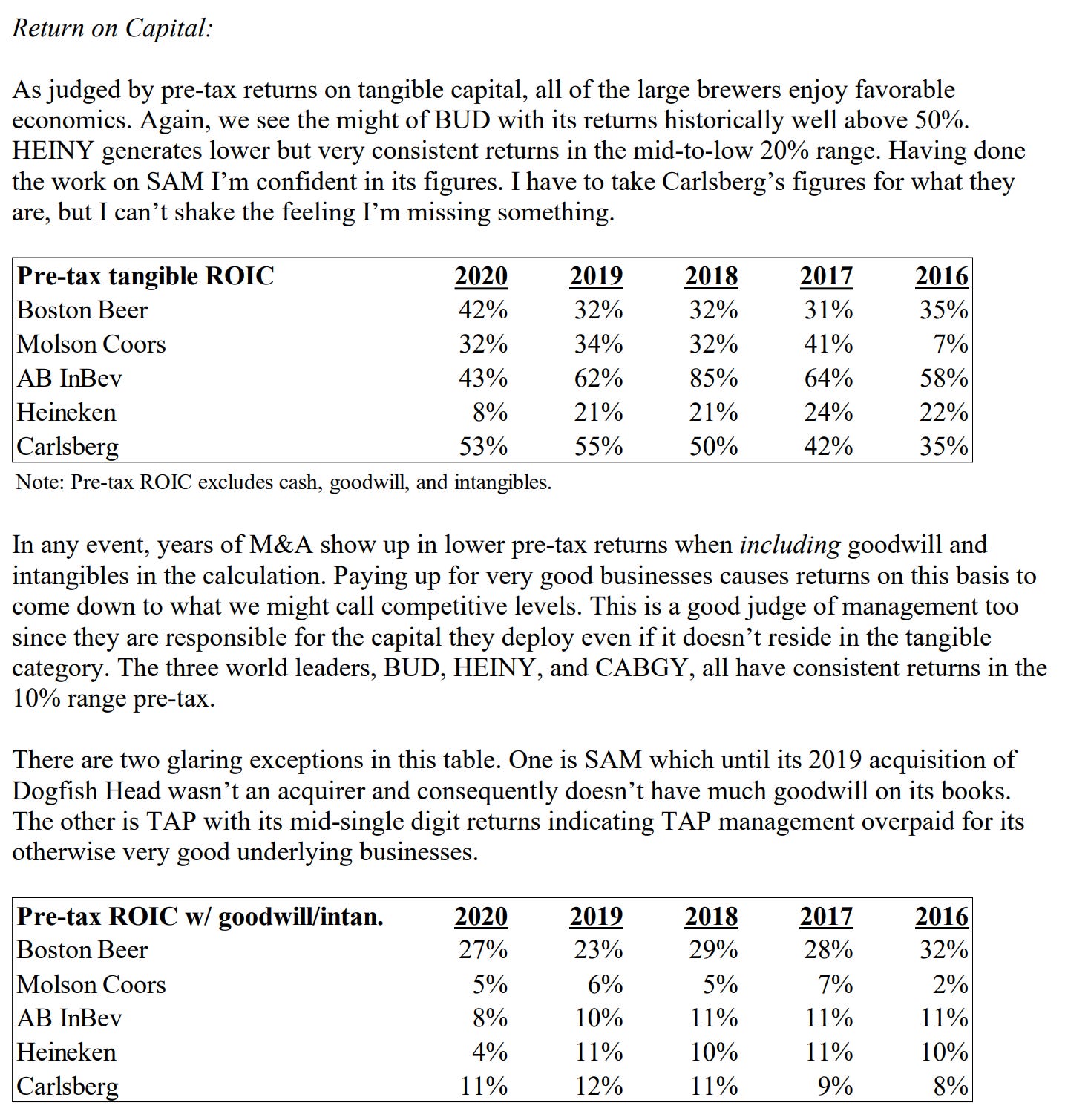

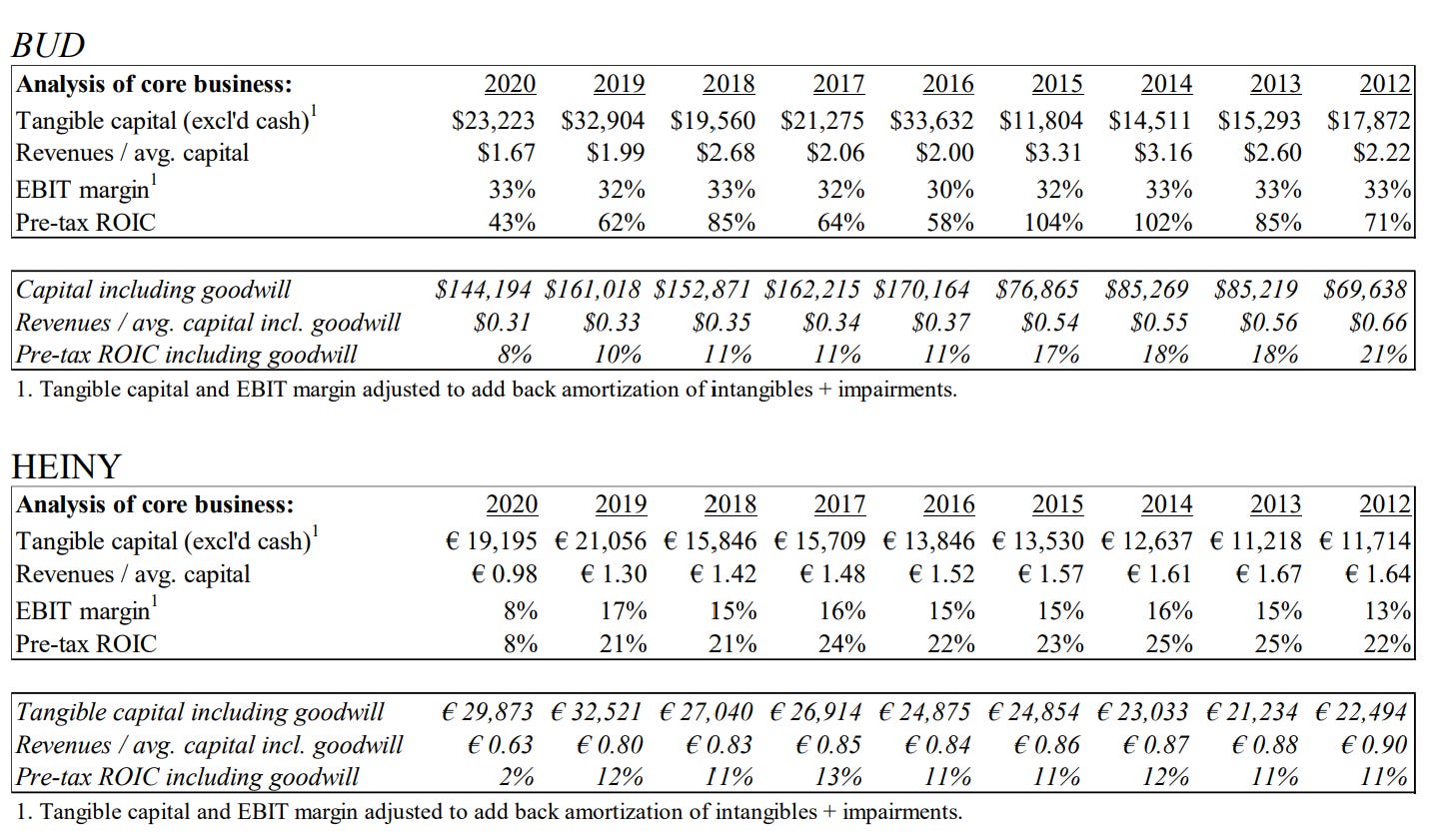

The worldwide market for beer consists of a tangled web of brands, cross-ownership, production/distribution arrangements, and regional strongholds. Sorted out, BUD and HEINY remain as the largest and most dominant corporate parents in a market that seems to be near the end of a decades-long process of consolidation.

In terms of global dominance, BUD has no peer. It commands twice the total volume of #2 HEINY and double the operating margin of its smaller peers. BUD also has a significant amount of debt and is controlled by two wealthy Belgian families together with the serial-acquiring force of 3G Capital. HEINY’s history includes its share of acquisitions. However, its management is directly connected to the company’s founder and flagship product, a protective force that helps the company remain long-term focused despite outside pressures.

Both BUD and HEINY are very good businesses possessing strong moats. Depending on one’s comfort level with balance sheet risk and valuation, either or both companies could be a worthwhile addition to a portfolio. Both are worthy additions to the Watchlist.

If you enjoyed this post I’d appreciate you taking a moment to help me spread the word by sharing it. Thank you!

Stay rational! —Adam