6/28/24: Weekly Roundup

Lots of Berkshire news this week (See's ice cream!), plus interesting developments in freight. And a battery train???

Watchlist Company News

Buffett’s Will: Buffett revealed to the WSJ that when he dies his fortune is not slated to go almost entirely to the Gates Foundation but instead will go to a newly formed trust to be overseen by his three kids. (Link)

$5.3 Billion Donation: Related, Buffett donated $5.3 billion in Berkshire B shares, which includes a majority to the Gates Foundation. Once he files with the SEC we’ll be able to back into Berkshire’s buyback activity since the Q1 filing date in May. (Link)

Berkshire - See’s: See’s Candies is partnering with ice cream maker McConnell’s to put its candy in ice cream. Flavors include Vanilla California Brittle, Banana Cream Toffee-Ettes, Chocolate Polar Bear Paws, and Coffee Molasses Chips. I’ll take all four, please! Though it appears they’ll only be available in California :( (Link)

Berkshire - BNSF: Berkshire’s railroad is adding a windscreen on one of its bridges in Texas. The screen will allow trains to safely cross the bridge during times of high wind. This goes to show that the work to maintain a railroad network is never done (link).

Berkshire - Clayton Homes: Clayton is increasing the energy efficiency of its homes by installing heat pump water heaters, among other upgrades. Equipping the company’s 42,000 home annual production volume with heat pumps will grow the heat pump market by a whopping 30%. Inflation Reduction Act tax credits mean Clayton can offer this and other upgrades without raising prices. (Link)

Triumph Financial: In a big win for TFIN, the company announced CH Robinson is joining its TriumphPay network. (Link)

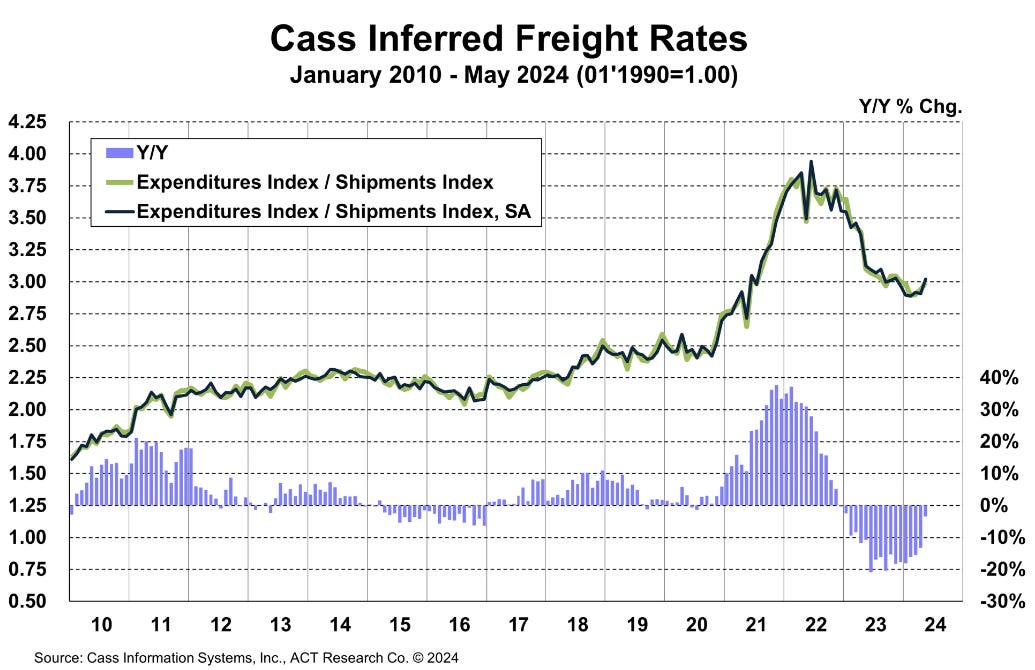

Triumph Financial: Truckload spot rates turned positive for the first time in 27 months. This bodes well for TFIN’s average invoice size. (Link)

This graph is through May, but you can see the depth and duration of the decline:

Other Freight Market News: According to the WSJ (link), UPS is selling its freight brokerage business for $800mm less than it paid for it in 2015.

What’s perhaps more interesting is speculation that FedEx will spin off its LTL trucking business. The company just consolidated all of its business units except LTL, and is conducting a “strategic review” of the unit. Based on the sky-high valuations of industry leaders, this seems like an opportune time for FedEx. (Link) (Link)

Other Interesting News / Links

Electric power by train: I came across SunTrain in an article in The Economist. The idea, which has been proven, is to put batteries in containers that fit on standard railcars and move them from areas of high power production to areas where power is needed.

On the surface, the idea seems funny, but it’s not that far-fetched. A lot of places have abundant power but not enough transmission lines to outsource the energy far enough to get paid for it. On the flip side, decommissioned coal plants and the like have all the infrastructure needed to pump power into the grid, including rail links.

This idea reminds me of when Amazon moved its data via a “Data Snowmobile” truck because it was quicker / cheaper than waiting for it to move across broadband.

Maybe this is something Berkshire could get into. (Link)

More Power News: A company created “neuron” sensors that allow utilities to send more power through their transmission lines. Utilities must operate with a large margin of safety, which often limits the capacity of their lines. With these new devices, they can now monitor the lines more closely and safely transmit more power, lowering ultimate costs to consumers. (link).

Stay rational! —Adam