80: Here Is How Much Warren Buffett Thinks Berkshire Hathaway Energy Is Worth

BHE's repurchase of Greg Abel's shares sheds light on its valuation.

You’re reading the weekly free version of Watchlist Investing. If you’re not already subscribed, click here to join 1,500 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives.

For less than $17/month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the growing archives.

Implied Value of BHE

Berkshire Hathaway Energy, the electric utility giant majority owned by Berkshire Hathaway, purchased shares owned by Greg Abel during the second quarter of 2022. A little math shows us how much Buffett thinks it’s worth.

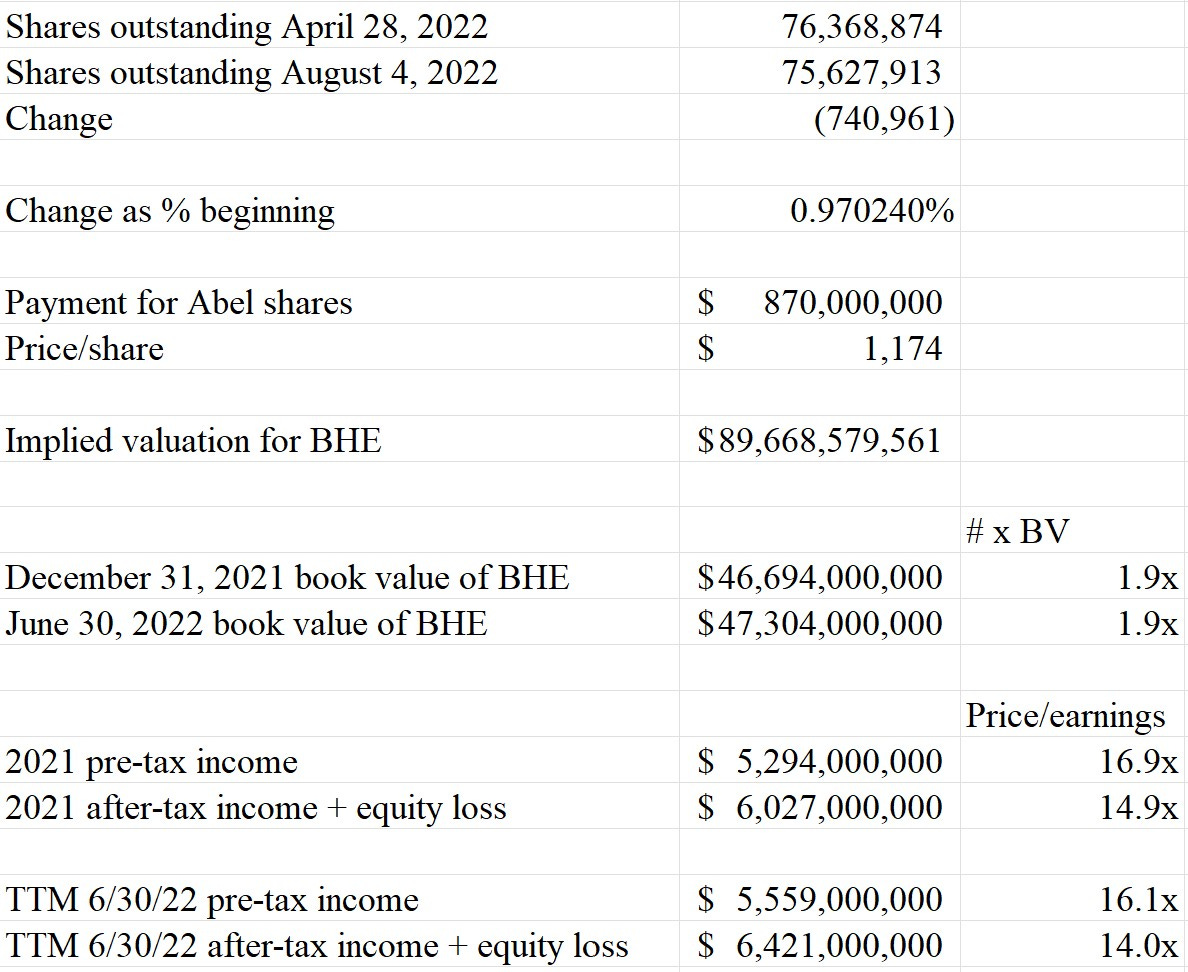

In BHE’s 10Q filing (it files with the SEC because it has publicly traded debt) BHE tells us that it purchased 740,961 shares for $870 million. Based on outstanding shares as of the prior quarter, this means Abel owned just shy of 1% of BHE.

Some quick division leads us to a valuation of just under $90 billion for the entirety of the business. The natural question is, how did Buffett get there?

Buffett’s Math

Price/book: Using a simple price/book metric BHE paid 1.9x book value.

Price/earnings: Depending on which set of numbers you plug in the P/E ratio comes out to between 14x and 17x, or an earnings yield of between 7% and 5.9%.

We can round off and say about 15 times, which is an earnings yield of 6.7%. BHE is an incredible collection of assets that has the ability to reinvest vast sums of capital. Many of its projects produce regulated returns in the low double digits (say 11% to 12%). A going-in return of around 7% for a collection of known assets and plenty of runway for growth is a very low-risk proposition for Berkshire.

Below is a table I put together for my book, The Complete Financial History of Berkshire Hathaway showing the implied valuation history of BHE beginning in 2015 based on shares purchased by BRK.

Today’s valuation of $90 billion shows it’s come a long way in a short amount of time.

Disclosure: It may not surprise you to learn I’m long BRK.

Stay rational! —Adam