90: Adventures In Accounting: Triumph Bancorp ($TBK) Charge-Off Analysis

The importance of reading the footnotes and understanding accounting cannot be overstated

You’re reading the weekly free version of Watchlist Investing. If you’re not already subscribed, click here to join 1,850 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives.

For less than $17/month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the archives, now 18 issues and growing!

Examining TBK’s Charge Offs

I’m in the process of writing a Deep Dive on Triumph Bancorp (Disclosure: Long) for the latest issue of Watchlist Investing and thought I’d share an interesting experience highlighting the importance of accounting.

For those less well-acquainted with banking, an important expense for a credit-focused financial company (i.e. one that lends money) is loan losses.

This brings us to the first accounting lesson.

Loan Losses and Charge Offs Are Two Different Things

Included in bank earnings is a provision for loan losses. In a perfect world, management would know exactly which loans would go bad and how much money they would lose on those loans. In reality, estimates are required. Like insurance companies, banks typically apply a statistical model based on the risk rating classification of their loan book plus any specific reserves.

What’s important to know is that these remain estimates and are separate and distinct from actual charge-offs of the assets on the books. This creates the “cookie jar” that managements can be tempted to sneak into to smooth earnings. A loan that’s charged off might not impact earnings because it was reserved in a prior year.

Using TBK as an example, in 2021 a $62.2 million portion of a purchased factored portfolio was deemed uncollectible and required a charge-off to the tune of $41.3 million. How did this affect earnings? Well, $37.4 million was already written off when the loans came on the books in 2020 through a mechanism called purchased credit deteriorated (basically they market the loans to market or what they deemed collectible based on known information). Then, later in 2020, management determined that it should reserve another $11.5 million against that asset because of asset quality, leading to an $11.5 million hit to earnings.

Still with me?

Okay, then in 2021, management charge-off $41.3 million of those loans. That means the assets were removed from the books. The hit to earnings and therefore equity was nil, however, because the reserving took place in 2020. You can see how this time-shifting can cause temptations.

It gets weirder.

What’s The “Right” Charge-Off Ratio?

What’s stranger is that TBK had secured a guarantee that required the seller of the portfolio to indemnify it for certain losses. TBK collected $35.6 million from this seller. However, it wasn’t recorded as an offset to charge-offs (called a recovery). Instead, it was initially booked as an indemnification asset and this asset was ultimately collected as cash.

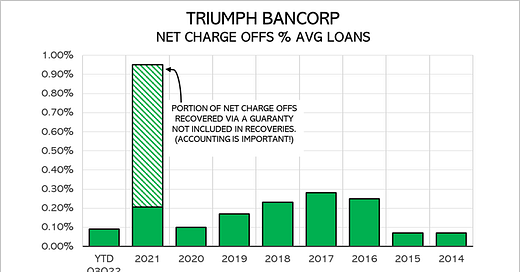

The effect of the accounting skewed the charge-off ratio to 0.95%. The true economic charge-off ratio was 0.21%. You can see this apparently huge jump in the charge-off ratio in the table below.

A Final Lesson: Do Your Own Homework

An investor or analyst not taking the time to dig into the numbers would probably miss this kind of thing. That’s why I don’t rely on services that present the data online or in nice downloadable spreadsheets. I think those are fine for quick looks into a business. You simply can’t build a spreadsheet from primary sources for every company you look at.

But if you’re seriously considering investing your money in a company you will benefit greatly from the exercise. Not only in understanding the company in question but it’ll help you come up the learning curve of accounting much faster.

As a bonus lesson, don’t be afraid to contact the company through its investor relations contact. You don’t have to be a professional investor or have any credentials to ask questions. My experience is that most management teams are eager to answer questions and help existing or potential investors understand their company.

Stay rational! —Adam