96: Charlie Munger's Pari-Mutuel System...In Reverse

What happens when the odds increase due to a decline in the stock price?

You’re reading the weekly free version of Watchlist Investing on Substack. If you’re not already subscribed, click here to join 2,100 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives, a separate paid service.

For less than $21/month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the archives, now 23 issues and growing!

My Decade-Long Experience With Cimpress CMPR 0.00%↑

Charlie Munger has related investing to the pari-mutuel system of horse betting. Participants betting on horse races often know which is the best horse. But the payoff is typically minuscule because everyone knows which horse will win. The trick is finding misplaced bets such that you receive an outsized payoff compared to the odds of the horse you’re backing. The analog in investing is that the obvious winners have their shares bid up to the point that even if the underlying company is successful the payoff isn’t very large.

I found myself thinking about this as I contemplated selling one of my smallest portfolio holdings, Cimpress, PLC. I’ve owned shares personally since 2014.

You might know Cimpress from its largest operating unit, Vistaprint, or perhaps have ordered or used pens from its National Pen business. Cimpress has multiple operating units, but all come down to what it calls mass customization – using technology to gain the economies of scale inherent in mass production but with customizable orders available on a smaller scale.

Cimpress faced many challenges over the past five years including the pandemic and now inflation. It’s also shifted away from a discounting strategy to one of integrating with small businesses and providing design solutions to them. It has done this via numerous acquisitions that span the globe.

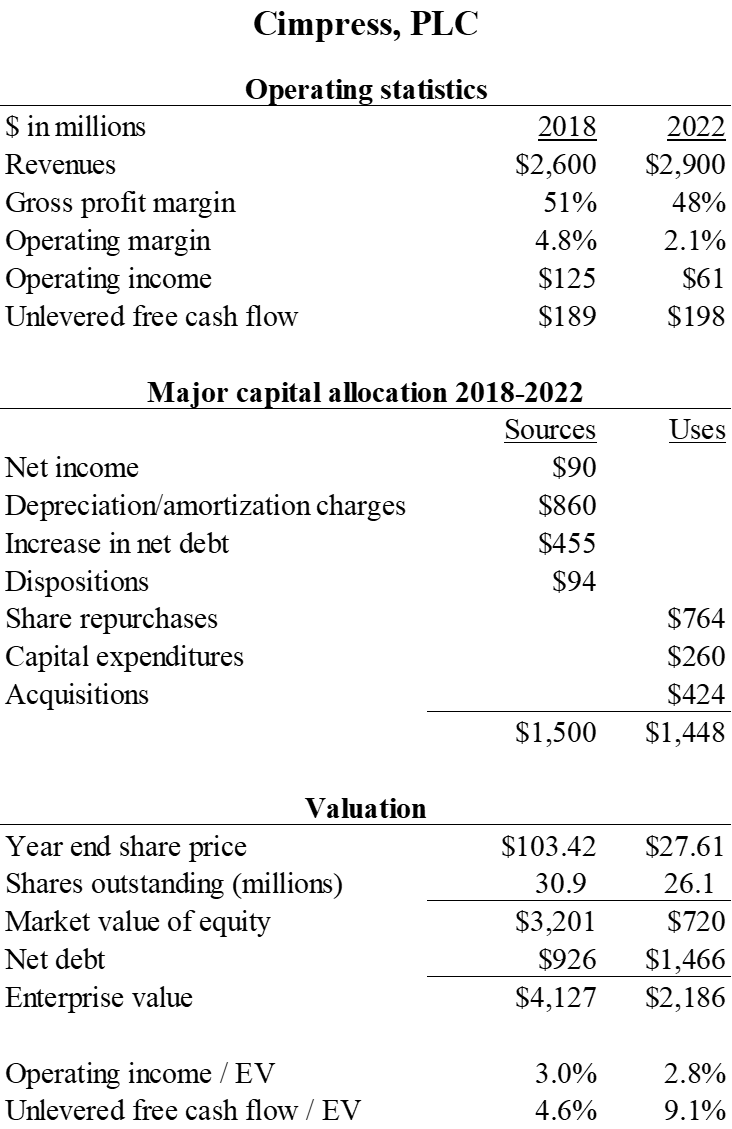

Over the past five years Cimpress management, led by Founder and CEO, Robert Keane, has allocated about $1.5 billion in capital. About half of that went to share repurchases and half went to acquisitions or capital expenditures. A large part or $860 million of that was funded via depreciation and amortization charges that flowed through the income statement. Another big chunk was funded via an increase in net debt.

The problem I face is the pari-mutuel system in reverse. By owning shares I’ve made the bet. But do I keep my ticket or sell it to another bettor at a lower price? Shares have declined so much (by about two-thirds from the end of 2018 to the end of 2022) that a potentially large future payoff makes holding shares the rational course of action. In other words, the horse has gotten worse, but the odds have increased significantly.

I’m conscious of the psychological biases that cause investors to hold when they should sell so that they don’t have to recognize the loss, both in the financial and the psychological sense of the term. I don’t think this is the case here. You might fault me for not selling earlier, and that’s fair. But given where we are now, I find myself thinking the rational course of action is to hold. The business has made some (albeit slow) progress over the past year, and the outlook appears satisfactory, if not brighter. Most important, I trust Keane and appreciate his candid reporting to shareholders.

Have you found yourself in a similar situation with a stock? How did you handle it? How did it turn out?

Stay rational! —Adam

You're 100% spot on. My intrinsic value estimate has gone down. But it's less than the drop in the share price so the dynamic is still there. Owning a stock, including holding, is an ACTIVE process of continual reassessment and evaluation. That's par for the course. It's definitely underperformed business-wise to what I'd expected.

I think there's a little bit of muddled thinking here: yes, the price has gone down but I'm not sure the odds have increased significantly because operating performance has been poor at the same time. I suspect your estimate of intrinsic value must have dropped alongside profit forecasts? I don't think you can conclude you should hold just because the price has dropped.

Compounding that issue, it sounds like business performance has been substantially worse than you expected? That should make you reassess your understanding of the business and its attraction as an investment. Even if you think the potential upside is higher, I think it's ok (and even advisable) to exit the position if there are signs that your understanding of the business is wrong.

Finally, your article makes it sound like capital allocation has been poor with a (unexpected) shift to acquisitions. If this is the case, it would be yet another reason to reasess the odds - and again it compounds the two problems above (misunderstanding of the business and it's prospects; and lower future cashflow to shareholders as some will be used for M&A).

Interested to hear your thoughts!