Issue 40.1: BRK Q2 2024 Update

Digging into Berkshire's Q2 results and an updated valuation (live Google Sheet)

As a Watchlist Investing Paid Subscriber, you’ll join corporate executives, professional money managers, and students of value investing receiving deep dives, updates on Watchlist companies, and more. Other benefits include access to a live Berkshire Hathaway sum-of-the-parts valuation model, private subscriber-only Google Meetups, and subscriber introductions. All paid subscribers have access to the entire catalog of back issues/posts.

Disclosure: Long BRKB.

The Big Picture

Berkshire packs a lot into its quarterly press releases. In half a page we can see a summary of operating earnings across its major business lines, the amount of share repurchases, shares outstanding, and the quarter-end insurance float.

Operating earnings show higher insurance underwriting earnings and higher investment income offset by modest declines from other segments save “other”.

Digging Into The 10Q

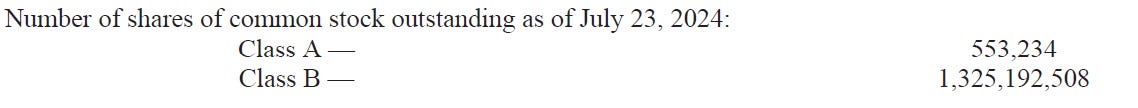

On the first page of the report, we can see shares outstanding three weeks into the quarter haven’t changed. Not a shocker given an increase in prices.

More Treasuries Than The Fed

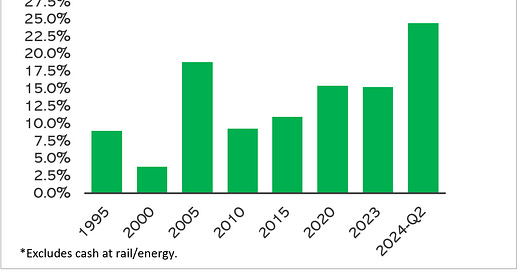

The news organizations always spoil the fun. Before digging into the 10Q I learned Berkshire sold half its stake in Apple and held more US Treasuries than the US Federal Reserve. Still, it’s amazing to see cash and Treasuries (ex. rail/utility) of $271 billion. That’s 30% of Berkshire’s market cap and nearly 25% of total assets! This sets a new record for cash on the books in absolute and relative terms.

Cash Flow Statement

The cash flow statement tells us a lot about Berkshire’s major capital allocation moves. Keep in mind this statement is for the first six months of the year.

Net Sale of Equities: The whopper is the $92.8 billion net sale in equity securities. Doing some quick math we see $75.5 billion occurred in Q2. The value of Apple shares was “just” $84.2 billion as of the end of the quarter.

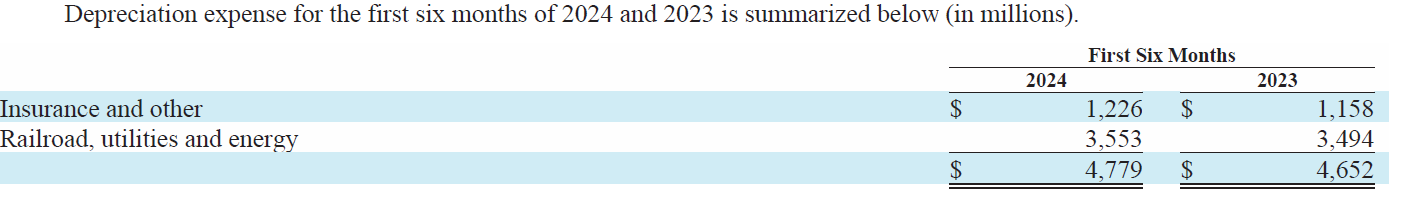

Growth Capex: Page 13 of the 10Q allows us to separate depreciation from depreciation and amortization on the cash flow statement. Using this figure we can see Berkshire spent $4.1 billion on growth capex, nearly double its depreciation.

Tuck-In Acquisitions: Just $342 million in acquisitions during the first half, putting Q2 at just $15 million.

Change In Debt: Net long-term debt declined by just $55 million in H1. We know from the Q1 report that in April Berkshire issued $1.7 billion in Yen-denominated bonds.

Buybacks: As noted above, all the action in repurchases in H1 occurred in Q1.

Operating Businesses

Insurance

On a high level, the Insurance Group continues to hit on all cylinders. Pre-tax operating earnings were 10.3% of premiums in Q2. That’s down from the 15.5% reported in Q1 but still falls into the category of printing money. A nearly 90% combined ratio is a very, very good result.

Keep reading with a 7-day free trial

Subscribe to Watchlist Investing to keep reading this post and get 7 days of free access to the full post archives.