Issue 41: Creightons, PLC Update

A turning point for the UK-based beauty products company; Subscriber meetup 9/20 at 11AM Eastern

As a Watchlist Investing Paid Subscriber, you’ll join corporate executives, professional money managers, and students of value investing receiving deep dives, updates on Watchlist companies, and more. Other benefits include access to a live Berkshire Hathaway sum-of-the-parts valuation model, private subscriber-only Google Meetups, and subscriber introductions. All paid subscribers have access to the entire catalog of back issues/posts.

Disclosure: Long CRL (LSE)

Meetup: Join me on Friday at 11AM Eastern to discuss this issue and more (link at the end).

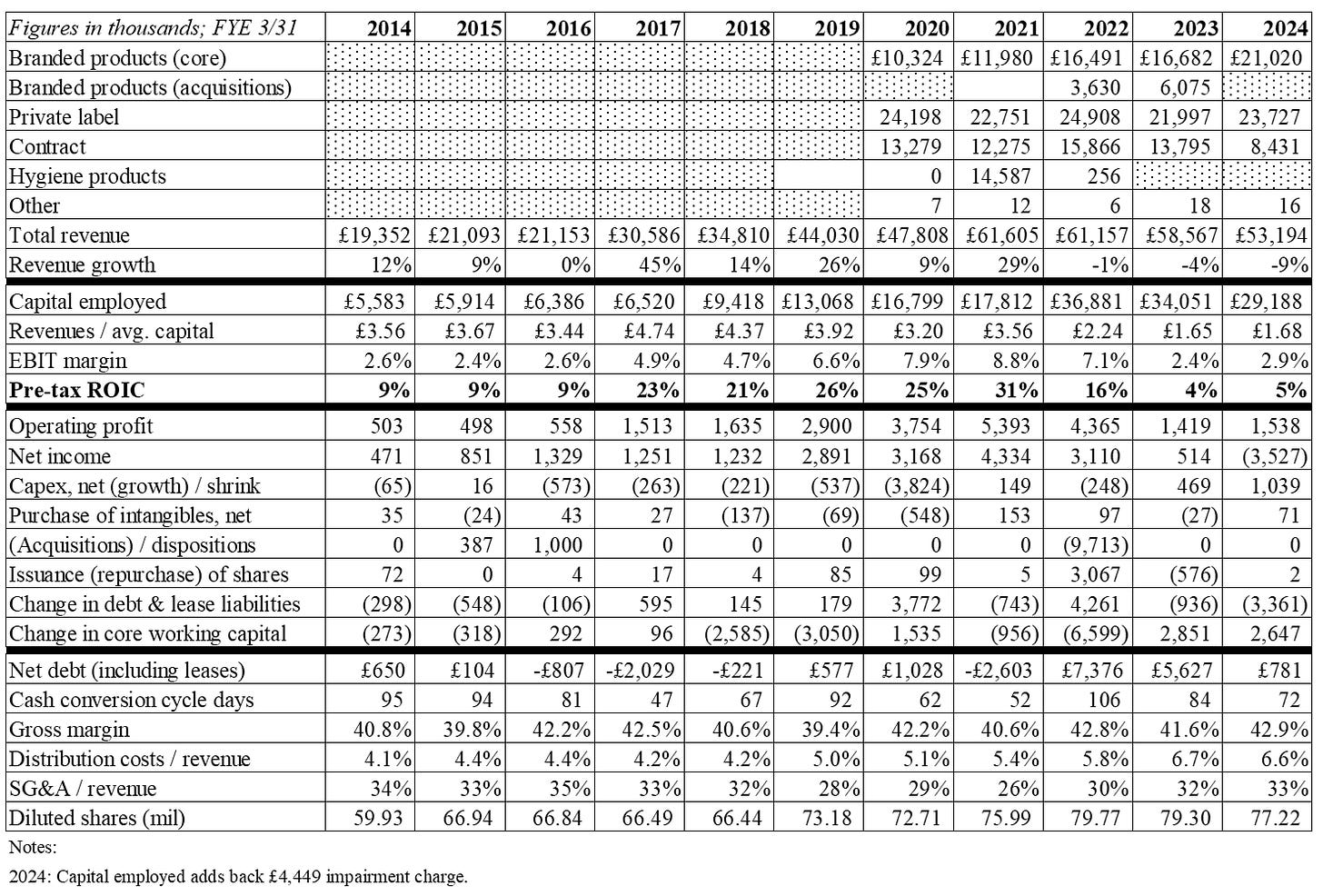

UK-based Creightons, PLC reported results for their fiscal year ended March 31, 2024.

The Quick Summary

The Board chose Pippa Clark (head of sales/marketing) to succeed Bernard Johnson as Managing Director (CEO). Longtime Chairman, William McIlroy stepped down from his role and significantly reduced his holdings. Other positions turned over, too.

Management shrunk the business to adapt to lower sales volumes, including bringing certain functions in-house and eliminating a shift.

The reduced topline reversed economies of scale leading to lower margins, although certain actions have created a leaner organization

The business remains profitable on a core basis but lost money after a £4.5MM charge against the value of its Emma Hardie subsidiary (acquired in July 2021).

H2 results were better than H1 indicating a possible positive reversal of fortunes.

Shares trade at 30p or about a £23MM market cap

Operating Results

Digging deeper reveals some important figures and considerations, including changes to the product lineup.

Keep reading with a 7-day free trial

Subscribe to Watchlist Investing to keep reading this post and get 7 days of free access to the full post archives.