Issue 42: Mainfreight Update

Operating results revert to long-run average but still trucking along. A lot to like but shares remain pricey.

As a Watchlist Investing Paid Subscriber, you’ll join corporate executives, professional money managers, and students of value investing receiving deep dives, updates on Watchlist companies, and more. Other benefits include access to a live Berkshire Hathaway sum-of-the-parts valuation model, private subscriber-only Google Meetups, and subscriber introductions. All paid subscribers have access to the entire catalog of back issues/posts.

Disclosure: None

Paid Subscriber Meetup: Join me on Friday, November 1 at 11AM Eastern to discuss this issue and more (link at the end).

Quick Summary

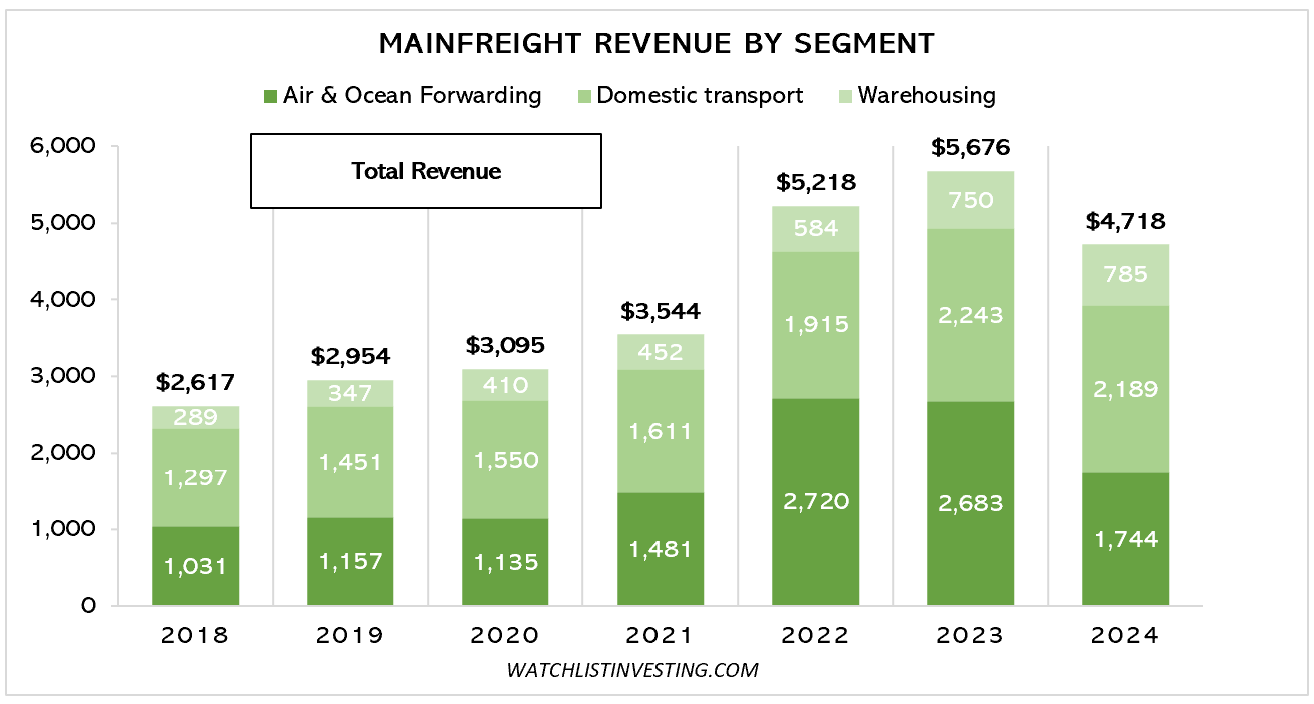

Mainfreight’s business reverted to a longer-term trend after two years of above-average results. Revenues declined by 17%, the first decline in over a decade.

Weaknesses were seen in Asia, Europe, and the Americas, with the US being described as a “problem child.”

The company continues to plan for the future, making additional investments in New Zealand and internationally where appropriate.

Net income declined 50% to $209 million. NI is up 11% compared to 2021.

The balance sheet remains in excellent shape.

A quirk in the accounting for capex to be aware of (more below).

Operating Results (All in New Zealand Dollars)

For FYE March 30, 2024, revenue declined for the first time in over a decade. Looking at the long term, the decline had more to do with the above-trend results in 2022 and 2023 than a major structural weakness in Mainfreight’s business. The pullback did, however, expose areas, such as in the Americas, where strong growth masked weaknesses that only came to light during the pullback.

Mainfreight’s business can be viewed by segment and geography. Starting with segment results, air & ocean forwarding fell by 35% to $1.74 billion as global volumes declined. Domestic transport fell by 2% to $2.2 billion. Warehousing was the bright spot with growth of 5% to $785 million. Comparing each category to 2021 results illustrates the progress made in growing each segment despite the recent pullback.

Looking more closely at volume highlights the 6% decline in land freight volume offset by increases in air and sea.

Keep reading with a 7-day free trial

Subscribe to Watchlist Investing to keep reading this post and get 7 days of free access to the full post archives.