Going once, going twice….

This is the last marketing email I’ll spam your inbox with in 2022. After that, it’ll be back to our irregularly scheduled free posts featuring timeless investing wisdom, thoughts, and analysis.

It’s also your last chance to lock in 2022 pricing for Watchlist Deep Dives, my paid newsletter featuring analyses of great businesses to add to your Watchlist.

Lock in the $199 rate forever

I dislike spam as much as the next guy. But it seems it’s a necessary evil, at least at this stage. I’m trying to get all the “pain” done in one year-end push to gain new supporters/subscribers and then get back to doing what I love most: analyzing good businesses.

Subscribe today and you’ll lock in the 2022 annual rate of $199 forever. Beginning in 2023 the price is going up to $249 per year for new subscribers.

This helps me as much as it helps you. You never have to worry about the price going up, and I can go to work confident I’ll have the support necessary to continue searching far and wide for companies to put on your Watchlist.

I’ve spoken to a number of happy subscribers and they’ve told me that I give away a ton of value. They’re surprised the price isn’t higher.

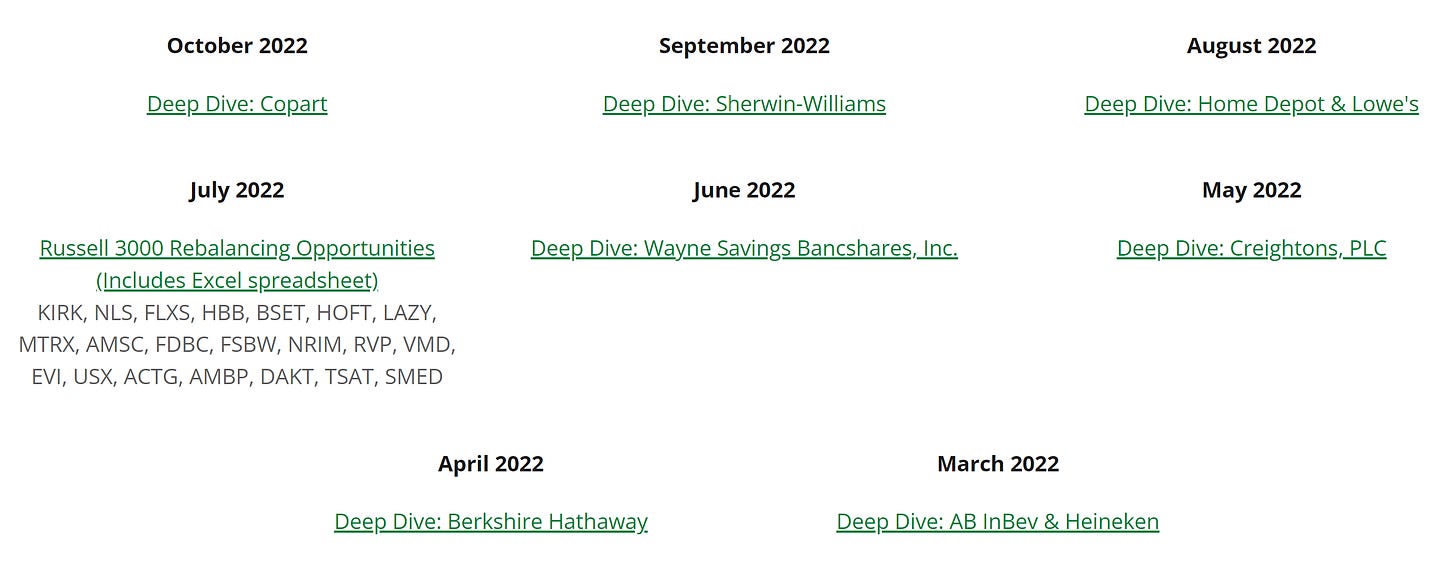

Watchlist Investing Deep Dives now features 20 back issues that paid subscribers can access anytime. And the list keeps growing! Yesterday I released a new Deep Dive on a small cap bank upending a sleepy industry and poised to become a leader in a niche segment.

I’ve always operated under an inverse margin of safety principle of delivering more in value than the nominal price of a subscription. It’s Charlie Munger’s advice to deliver to the world what you would want if you were on the other side.

Researching stocks like Copart, UK beauty products nanocap Creightons PLC, Berkshire Hathaway, and the rest takes hundreds of hours of time. As a subscriber, you gain access to all of that bottoms-up research in a nice tidy package usually 20-25 pages long.

What You’ll Get

Deep Dives take you through everything you need to know to get up to speed on a potential investment. I like to start with an industry overview to set the stage for how the business fits into the broader economic landscape among its peers. A discussion of the company’s business model follows so you can get an idea of how the business makes money. A bullet-point company history and management/ownership summary tell you where the business has been and who runs it.

I spend a lot of time thinking about the few key variables that truly drive the business and force myself to keep it to no more than two or three. Then I’ll go into a full financial analysis of the business, touching on key aspects of the income statement and balance sheet, and how they all fit together. A ten year capital allocation analysis shows you the sources and uses of cash over the preceding decade as I offer an assessment for how well management has done allocating its owner’s resources. I’ll then move into a valuation analysis, giving you my thoughts on what the business is worth. Finally, I’ll point out the key risks I think should be considered when assessing the viability of an investment. Each issue also includes my “spreads” of the company’s financial statements and key ratios.

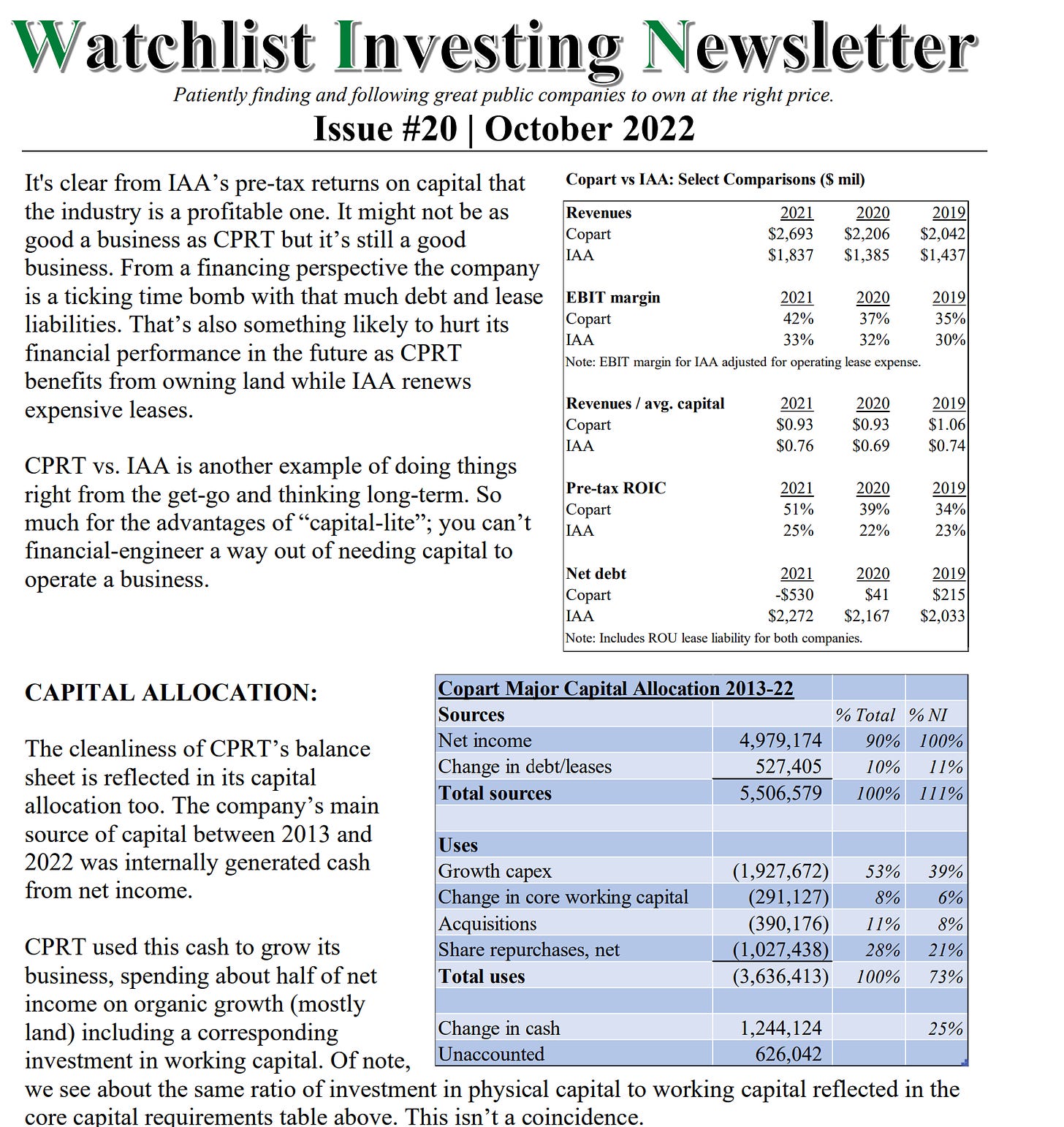

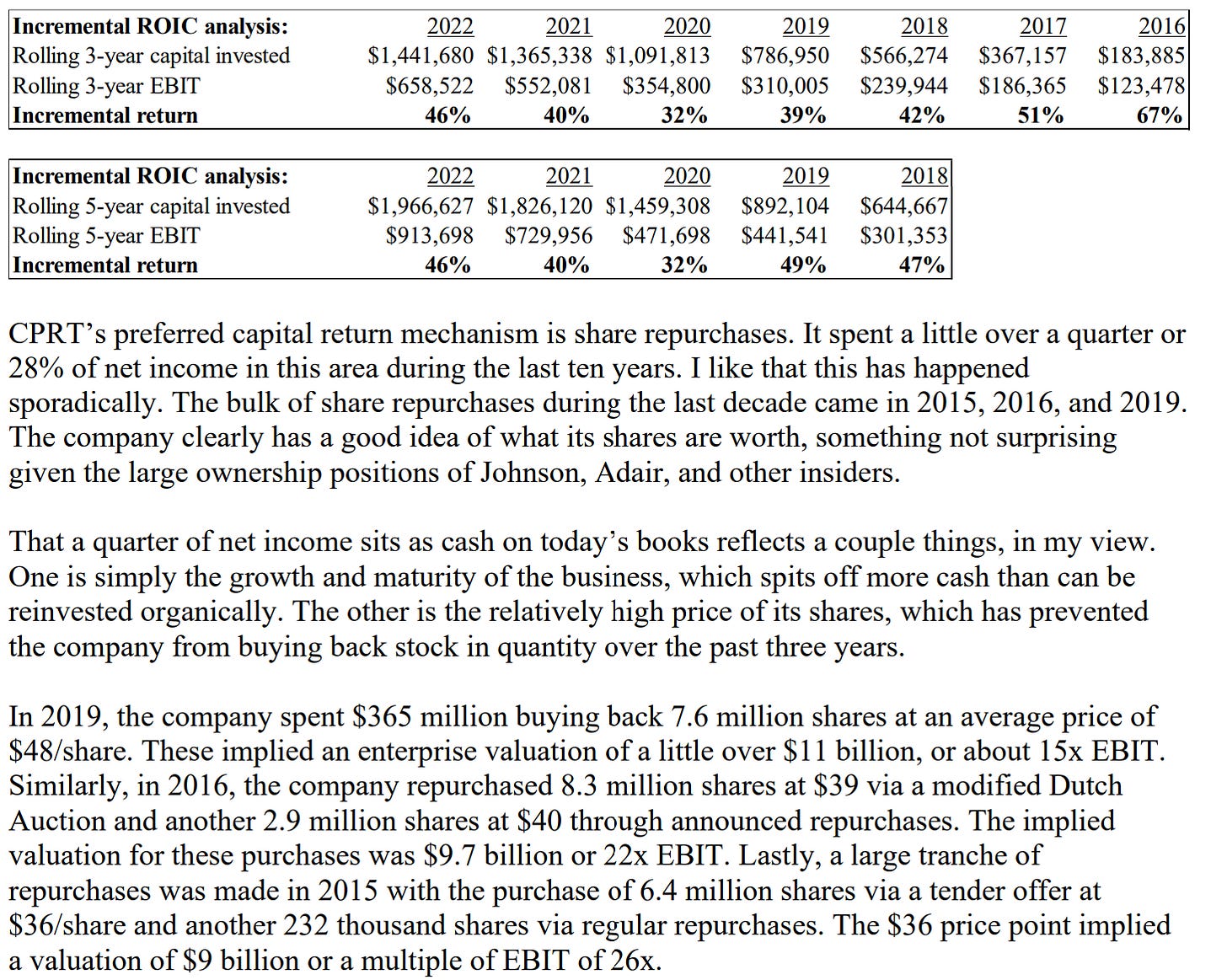

As an example, here’s the capital allocation section from the October issue on Copart.

Check out some sample issues of Watchlist Investing Deep Dives here, including Hingham Institution for Savings, Boston Beer, and the waste management industry.

Other Perks: Live Google Sheet, BRK Valuation Model, Subscriber-Only Meetups

As a subscriber, you also gain access to the Watchlist on Google Sheets with live prices. In addition, I’ve added a real-time Berkshire Hathaway valuation model that features a sum-of-the-parts analysis of the conglomerate. You’ll also gain access to subscriber-only Google Meetups where we discuss the latest issue and other topics of interest to the value investor.

Still not sure? Check out some sample issues of Watchlist Investing Deep Dives.

Student discounts!

I’m happy to provide a student rate of $99. That’s 50% off the headline rate. I think it’s so important that students have access to quality, relevant, and actionable research material when they’re learning the craft of value investing.

Please email me from your school account after subscribing and I’ll apply the discount prior to your card being charged.

Stay rational! —Adam