Scouring The Russell 3000 Discard List (#13)

Every year companies get kicked out of the Russell indexes. That's an opportunity to find value.

The Russell 3000 Project

The Russell indices are rebalanced every year to maintain appropriate sizing of companies into the correct size/style buckets. This annual reshuffling can create opportunities to buy companies whose stock prices are artificially driven down because of forced selling by index-tracking ETFs and the like.

This year the cutoff to remain in the Russell 3000 or Russell 2000 is a market cap of $257 million (there are a few larger-capitalization companies that got cut because they couldn’t maintain other requirements, like public float, domicile, etc.). The initial list was provided on June 4 and the final rebalancing date was June 25.

Here’s a nice graphic of the various indices and their cutoff points for 2021. You can see the floor created by starting from the top down, which creates the $257 million cutoff.

This project began a few months ago and culminated with a sortable spreadsheet with company names, descriptions, market caps, and some price data. Here’s a Google Sheet with data on the Healthcare and Financials segments. (Subscribers to the monthly paid version of Watchlist Investing have access to a full sortable Excel spreadsheet.)

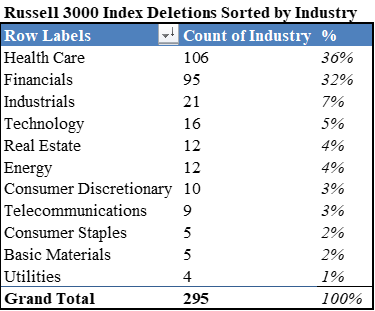

As seen below, the list is heavily weighted toward Health Care and Financials, which together comprise two-thirds of the entire cut list.

The search for financials prompted this entire exercise. The stats for financials break down as follows:

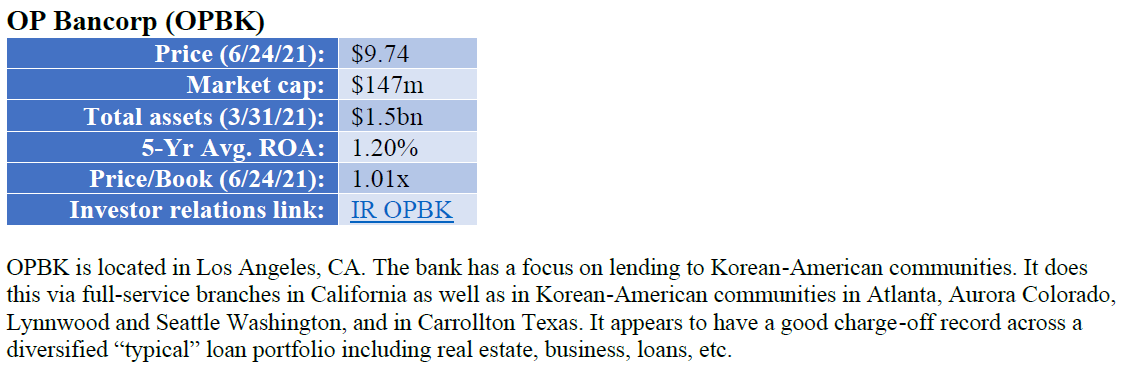

Here are a couple of the companies that came out of the search: