75: WAYN: An Interesting Bank Turnaround

You’re reading the weekly free version of Watchlist Investing. If you’re not already subscribed, click here to join 1,400 others.

Want more in-depth and focused analysis on good businesses? Check out some sample issues of Watchlist Investing Deep Dives.

For less than $17/month, you can join corporate executives, professional money managers, and students of value investing receiving 10-12 issues per year. In addition, you’ll gain access to the growing archives.

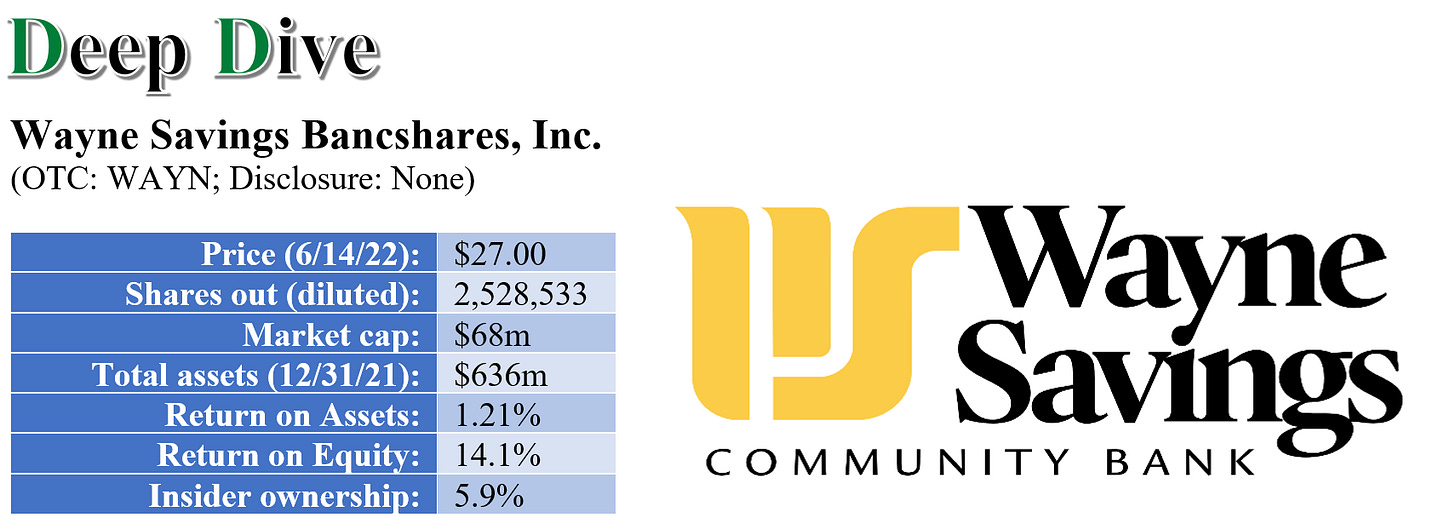

Ohio-based bank WAYN came on my radar after a poking around a list of nano cap and small cap banks.1 What I found was an interesting case study of a bank apparently made better through the trials of an activist campaign.

Prior to 2017, WAYN consistently operated below its peer group, as judged by return on assets (see chart). In 2017, Joseph Stilwell, a New York City-based activist bank investor, began a campaign to elect a board member. This campaign and one the next year, failed, however. Soon after, WAYN converted from a savings and loan to a commercial bank, and hired a new President and CEO, James VanSickle II, who began improving the bank’s operations. How much of this turnaround can be attributed to Stilwell vs. VanSickle is up for debate. What’s clear is the 2017 demarcation point. It’s also interesting to note that Stilwell still owns over 10% of the bank despite his two failed campaigns to elect a board member.

WAYN’s recent history of execution under VanSickle’s leadership and improving fundamentals, together with a price modestly above book value, lead me to believe it’s a good candidate for the Watchlist.

FOCUS / MARKET AREA:

Ohio has a population of about twelve million people with a median age of 40 years. Its population grew just 2.4% overall between 2010 and 2022 according to demographic data.2 Economic data suggest that the counties in which WAYN does business are slightly below the US average but roughly in-line with Ohio’s average.

WAYN operates twelve branches in Northeastern Ohio, specifically in the counties of Wayne, Holmes, Ashland, Medina, Stark, and Columbiana. The bank is headquartered in Wooster, which is in Wayne County. Wooster is roughly halfway between the larger cities of Akron and Columbus (see map below).

WAYN looks like a typical smaller community bank with ordinary deposit and loan operations. Its branches offer the standard suite of deposit services to individuals and businesses. Its lending operations consist primarily of one-to-four family residential lending (38% of the loan book), commercial real estate (49%), and commercial loans (9%), with the balance made up of construction loans, multi-family, and consumer loans. In 2012, WAYN divested a struggling trust department.

KEY VARIABLES / METRICS:

A well-run bank does two things: It focuses on keeping overhead and loan losses low. These are really the two primary drivers that feed into return on assets.

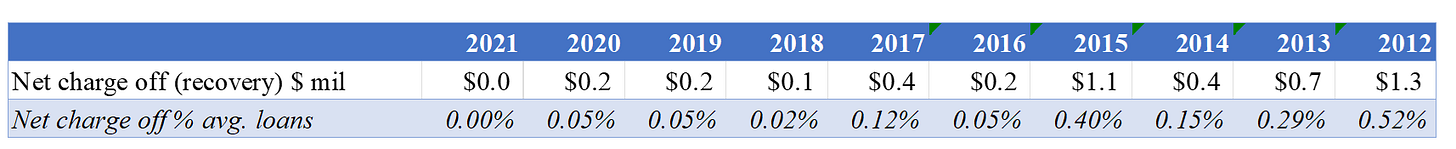

Key metric #1: What is the history of actual loan losses?

The quality of the loan book is the most important metric to pay attention to. Actual write-offs tell the best story. Reserving is important but subject to management estimates.

Looking at WAYN’s history of net charge offs it’s clear that the current management team has a focus on keeping loan losses to a minimum. The caveat here is the operating environment of the last decade has kept loan losses down industry wide. It’s easy to avoid losses at the top of a credit cycle. The real test will come during the next downturn.

Key metric #2: How well does the bank control costs?

Controlling costs is the second major variable management can influence and one that has an outsize impact on future returns.

I decided to look at this in two ways. One is the traditional definition of a bank’s efficiency ratio, which is:

What I don’t love about this ratio is that it includes non-interest income. Banks overly reliant on income from fees will inevitably suffer as competition drives them down and out. Better to rely on actual expense discipline. For this reason, I’ve also included the ratio excluding non-interest income.

The trend either way is clear. WAYN has made great progress over the past decade operating more efficiently.

Subscribe to Watchlist Deep Dives to continue reading this 16-page analysis, including my estimate of intrinsic value.

Stay rational! —Adam

I’m often asked how I generate ideas. This is a case where a simple Google search turned up an interesting company that hadn’t made it on my radar screen before. Sometimes a bit of randomness is all it takes to bring something to the surface.