A trip to the beach yesterday had me thinking about waves: Waiting for the right one and surfing it all the way to shore. (I promise what follows is more directly investing-related than last week’s essay on training wheels and learning to invest.)

Lesson 1: Be patient. Wait for the right wave.

My kids were so excited to bodyboard for the first time that they just took the first wave that came their way after riding the last one. It took some convincing and trial/error for them to realize they’d have more fun if they looked to the horizon and waited for a sizable wave.

In investing we have waves coming toward us all the time. Stock prices gyrate daily and offer opportunities to get on board. We must be patient, sometimes to the extreme, to catch the right one. It’s much more work and much less enjoyable trying to ride each little wave - each slightly undervalued security - than to simply sit there, let a few go by, and look out for the big one. Not only is it less stress and effort, but the big waves, the big opportunities in the stock market, take us farther faster.

Lesson 2: Surfing is much less effort

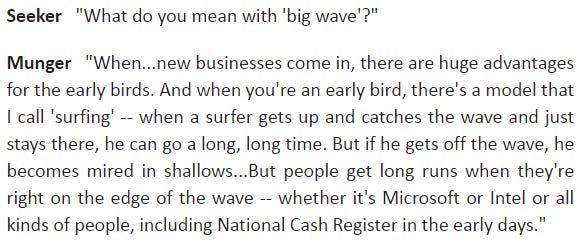

Charlie Munger has discussed the mental model of surfing. For readers who live inland or aren’t familiar with surfing, it takes far less effort to sit there on the edge of a wave and ride it in. If you mistime it or fall off the wave you quickly find yourself at a standstill.

Some businesses get to surf (see below) because of the advantages of their business model or situation, random or cultivated. Something just comes along that helps their business and they ride the wave to its fullest. That wave might be those like Munger references below, or it could be something like Coca-Cola that has benefitted from both population growth and rising per capita incomes worldwide. Or it might not be an early mover like Munger’s examples. Think about BNSF, Berkshire’s railroad. The rail industry rationalized its model to be multiples more efficient than trucks, and it will have a long way to surf on its success before something else comes along to disrupt it (like autonomous trucks).

From Peter Bevelin’s book, All I Want To Know Is Where I'm Going To Die So I'll Never Go There

Stay rational! -Adam