17: On Training Wheels & Learning To Invest

Literal and figurative training wheels help us go farther, faster

Just yesterday my oldest daughter rode her bicycle without training wheels for the first time. She did really well. I’m beyond proud and excited for her. But I promise this isn’t a beaming-parent-type post. Instead, it got me thinking about other types of training wheels, both literal and figurative.

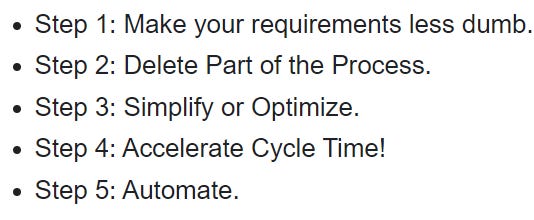

Slight detour but I promise it’s related: I’m an amateur “space nut” and have followed the development of SpaceX. Last week Elon Musk gave a walking tour of the Texas facility, and along the way explained his process for moving at such blazing speeds to send rockets into space and people to another planet. He explains that process at this point in the video (the whole series is worth watching in its entirety).

This process (summarized below) can be thought of as training wheels of sorts. You slow down, get your process working, and only then do you speed up. Just like riding a bike.

“Slow is smooth and smooth is fast.” - Phil Dunphy, Modern Family

Alright, how does this all relate to investing? Well, investing is a skill that takes time to learn. You need the right amount of knowledge and you need practice. You watch and study the greats but then, at some point, you have to take the training wheels off.

Starting with a play money account doesn’t cut it, you need to put some real hard-earned money on the line.1 Just like riding a bike, some degree of risk and actual failure help you learn faster. Keeping a decision journal and adding to your knowledge by learning from the mistakes of others helps immensely. You just keep iterating and learning and, eventually, you get better.

We’re drawn to investing because of the power of compounding. Let’s not forget that to compound wealth requires the compounding of knowledge and wisdom too. Use those training wheels as a tool and just keep learning.

Stay rational! -Adam

Check out the paid version of Watchlist Investing, which features Deep Dives and Quick Looks into companies to help you be in a position to move quickly when Mr. Market overreacts and presents buying opportunities.

Start small. Don’t risk your entire nest egg. But make it enough so that when (not if) you mess up it hurts and sears in the lesson for good.