The perfectionist in me is trying to get comfortable publishing more frequently. Not simply to “generate content” but to share short, perhaps incomplete or imperfect notes/research that may be useful to readers. I figure an imperfect update from me might be better than a reader completely missing a piece of information on a watchlist company because I was too afraid to hit send.

I’d appreciate your feedback in the comments.

Medifast 2024 Update

Disclosure: Long

Revenue for the full year decreased 44% to $602.5 million. Active earning coaches declined from 41,100 at Q4 2023 to 27,100 at Q4 2024 (-34%), and revenue per coach declined from $5,538 to $4,391 (-21%). The company points to a slowing decline in coach atrophy: down 5.5% in Q4 vs. -22.2% at Q1.

Gross margin increased by 140bps to 73.8% from lower costs, lower inventory donations and efficiencies.

SG&A decreased 32% and increased as a % sales from 60.6% to 73.3%. The company attributed the increase as follows:

330bps due to company-led acquisition efforts

330bps due to loss of leverage on employee comp

160bps due to loss of leverage on fixed costs

200 bps due to supply chain optimization.

The supply chain optimization of $12.5mm:

• Loss on impairment of equipment held for sale: $2,499 thousand. This loss resulted from the closure of the Maryland Distribution Center and the sale of its assets.

•Accelerated depreciation charges: $9,190 thousand. These charges were due to the adjustment of the useful lives of certain underutilized supply chain assets at other locations .

•Non-cash charges for supply chain optimization: $11,689 thousand. This appears to be the sum of the loss on impairment and accelerated depreciation.

•One-time severance costs: $813 thousand. These costs were incurred as part of the distribution center closure.

Adjusting for these one-time items EBIT was $15mm.

Additionally, the company paid the second of two $5mm payments to LifeMD, which won’t repeat. It seems to me this LifeMD partnership was a dud, but maybe there’s more to it or it hasn’t reached fruition. At the very least these payments shouldn’t reoccur.

Adjusted for the one-time items, profit, cash flow, and return on capital were satisfactory.

In the latest earnings call the company points to $24mm marketing spend in 2024 compared to about $4mm in 2023. They won’t disclose plans for 2025, but anticipate lower marketing spend as “non-working” (i.e. design, etc. ) vs the actual ad spend itself won’t repeat in 2025. They anticipate spending more on coach comp. this year.

Additional bullets from my read of the Q4 conference call transcript:

% customers who have used GLP-1 = 17%, up from 3% at beginning of 2024

22% of coaches have used GLP-1.

2025 priorities: 1. customer acquisition, 2) coach productivity, 3) advancing clinical research

Most customers getting prescription thru own provider, not LifeMD

Canceled credit facility in October 2024 (they don’t think they’ll need the liquidity)

Valuation

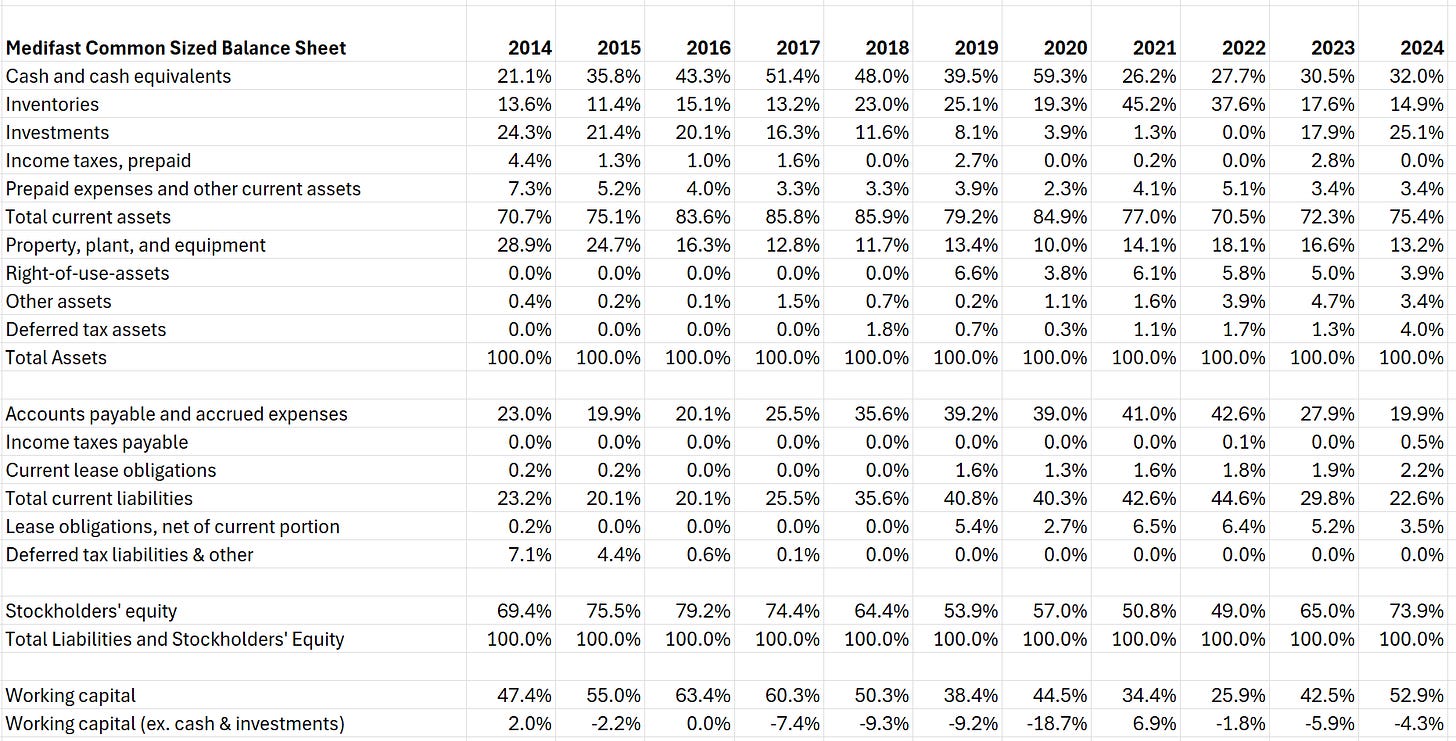

Valuation remains attractive. The company has $162mm cash and investments as of Q4 2024 and just $10mm lease liabilities. Compare that to a market cap of $135mm. As long as MED doesn’t die, owners should do okay from here. Then again, this could be a melting ice cube that leaves buyers with nothing but wet hands.

Caveat Emptor!

Stay Rational!

Adam

Thanks for the update Adam. I too am long $MED.

One aspect of the story I don't often hear mentioned is the state of Medifast's two largest competitors in the traditional weight loss services industry - Weight Watchers and Nutrisystem (privately owned by PE backed Wellful Inc. which also owns Jenny Craig) both of which carry substantial debt on their balance sheets.

The former is rumoured to be starting bankruptcy proceedings with the latter likely not too far off:

https://www.msn.com/en-us/money/companies/weightwatchers-prepares-for-bankruptcy/ar-AA1CCldS

https://www.bnnbloomberg.ca/investing/2024/11/08/nutrisystem-jenny-craig-owner-wellful-prepares-a-debt-overhaul/

If there is room for a traditional weight loss services company to exist alongside the GLP-1's, which I believe there is, it seems Medifast, with a debt free and cash rich balance sheet, is the most likely contender and could also pick up market share from its beleaguered competitors.

Thanks for the update Adam. To give you some feedback, short notes, even if not perfect, are useful especially if they can open conversations among readers.

P.s. it would be nice to have an active group / chat, I've seen one in discord but it seemed inactive last time I checked :)